Economics for Business Decisions/Theory of Demand and Supply

Demand

[edit | edit source]Demand is equal to desire plus ability to pay plus will to spend.

Demand = Desire + ability to pay + will to spend Ability to pay: money/purchasing power

Definition of Demand: Demand refers to desire to have a commodity backed by willingness and ability to purchase that commodity at given price during period of time

Determinants (Influencing factors of Demand)

[edit | edit source]Demand for a commodity depends upon number of factors called Determinants. The demand function can be symbolically expressed as:

Where:

- QdN = Quantity demanded for the commodity

- PN = Price of the commodity

- PR = Price of related commodity

- I = Income of consumers

- T = Taste & preferences of the consumers

- E = Expectations about the future prices

- O = Other factors

Price of commodity (PN)

[edit | edit source]

Generally, it is expected that with a decrease in the price of a commodity, the demand for the commodity increases and with a rise in the price of a commodity the demand decreases. That is, there is an inverse relation between them.

Price of related commodity (PR)

[edit | edit source]

Demand for a related commodity depends upon the PR. There are two types of related commodities, complimentary and substitute:

- Complimentary Goods: If two goods are used together to satisfy a want, they are said to be complimentary goods. For example: tea and sugar, automobiles and petrol, pens and ink.

- A fall in price of a commodity raises the demand for its complimentary goods. For example, the demand for petrol increases when prices of automobiles fall. It means with fall in price of ink, the demand for pens raises.

- Demand for a commodity is inversely related with price of its complimentary goods.

- Substitute Goods: Those goods which can be used in place of one another are called substitute goods. For example: tea and coffee, scooter and motorcycle, etc.

- The existence of alternative goods (substitutes) to satisfy a given demand divides the total demand among the many different goods. The larger the number of substitutes, smaller will be the demand for anyone of them. For example, with an increase in the price of coffee, the demand for its substitute (tea) increases.

- Demand for commodity is directly related to the price of its substitute.

- A fall in price of a commodity results in lowered demand for its substitute, and an increase in the price of a commodity results in increase in the demand of its substitute.

Income of Consumers (I)

[edit | edit source]

The demand for goods also depends upon the income of consumers. With an increase in income, the consumer's purchasing power increases, because he is in now in a position to buy more goods. Consequently, the consumer's demand for goods increases.

There are three types of goods for each of which the effect of income differs:

- Normal Goods: Increase in income has a +ve effect on the demand for goods. Generally, income of the people is directly related to their demand. That is when "I" goes up, demand for Normal goods goes up and when "I" falls, demand also falls. example: laptop, etc.

- Thus there is a direct relationship between income and demand of normal goods.

- Necessity Goods: For certain goods called necessities, demand is not related to income. Salt, petrol, and LPG are considered necessity goods.

- Demand for salt does not increase with the increase in income and does not decrease with the decrease in income. It means that it is irrespective of income.

- Inferior Goods: Goods are said to be inferior goods if its demand falls with increase in income of the consumer. Thus there is an inverse relationship between income and demand of inferior goods.

Taste and preference of consumers (T)

[edit | edit source](A) favourable change (B) unfavorable change

(a) Demand for a commodity increases when there is a favourable change in the taste and preferences of a consumer towards the product.

(b) demand for a commodity decreased when there is an unfavorable change in the taste and preferences of a consumer towards a product

Expectations about future prices (E)

[edit | edit source]

Future prices of goods also affect their demand particularly for consumer durable goods. Since purchase of durables can be postponed or preponed more easily than those of non-durables.

If for some reason consumers expect prices of certain goods to rise in near future, they tend to demand more for it, in the present even at increasing prices.

On the other hand, if they expect prices to fall in the near future, they will demand less of it in the present.

Other factors (O)

[edit | edit source]

- Size and regional distribution of population: A rise in population leads to an increase in the number of consumers. As a result demand, increases.

- The greater the number of consumers, the greater the market demand for a commodity. Therefore, demand for a commodity is directly related to the size of the population.

- Regional distribution of a population also affects the demand.

- Composition of population:

- If there are more children, demand for goods like toys, biscuits, sweets, etc will increase.

- Similarly, if there are more old people, the demand for goods like glasses, canes, hearing aids, medicines, dentures and so on will increase.

- Predominance of young people in the population will raise demand for goods like mobile phones, clothes, hair gels and other related products.

- Distribution of income: Equitable distribution of income leads to increase in demand and unequal distribution of income leads to decrease in demand.

- Weather and climatic conditions: Changes in weather conditions also influence demand for a product. For example, a sudden rainfall on a hot summer day brings down the demand for ice cream and cold drinks.

- Taxation: Higher taxes imposed on a commodity will lower the demand for that commodity, and vice versa.

- Technical progress (inventions and innovations): It leads to production of new attractive quality products at fair prices. Latest LCD, 3G, etc.

- Advertisement effects: Preferences of customers can be affected by advertisement and publicity, leading to greater demand for a product.

Law of Demand

[edit | edit source]Also known as "first law of purchase", explains the inverse relationship between price and demand.

Price α 1⁄Demand

Statement of Law of Demand: "Other things being equal (constant), as price of commodity falls, demand extends that is demand rises and as price increases, demand contracts i.e. demand decreases."

Assumptions

[edit | edit source]QdN = f (PN) cet. par ceteris paribus: other factors being constant

- Price of related commodity (PR) must remain constant.

- Income of household (I) must remain constant.

- Taste and preferences (T) must remain constant.

- Composition and size of population must remain constant.

- Distribution of income should remain constant.

- Taxation policy, National factors, Technology, etc., should remain unchanged.

- There should not be any future expectations about change in the price.

Explanations

[edit | edit source]The law can be explained scientifically using multiplicative model as,

- Let the average individual hypothetical demand function be:

QdN = (6-PN)cet. par

- Let the number of households in the market for commodity be = 100

- Then the market demand law under multiplicative model will be:

QdN = 100 (6-PN)cet. par QdN = 600-100PN

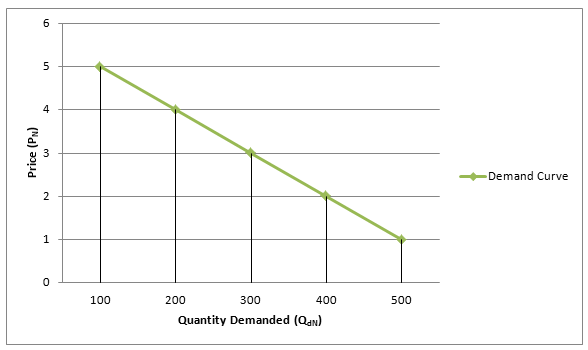

Demand Schedule:

| Price of commodity (PN) $ |

Quantity Demanded (QdN = 600-100PN) |

| 1 | 600-100=500 |

| 2 | 600-200=400 |

| 3 | 600-300=300 |

| 4 | 600-400=200 |

| 5 | 600-500=100 |

As price increases from 1 $ to 5 $, QdN contracts from 500 units to 100 units and vice-versa.

Thus the schedule expresses negative/inverse relationship between price & quantity demanded.

From the table it is clear that individual consumer demanding more at lower prices and less at higher prices. This can represented graphically as follows:

Graphical representation:

X and Y axis respectively represent quantity demanded and price. Demand curve slopes downward from left to right.

Demand curve is a curve derived by joining various points showing the quantity demanded and the price of a product. and it indicates consumers behavior i.e. an individual consumer demands more at lower price and less at higher price.

Thus, it indicates there is inverse relationship between price and quantity demanded cet. par. Thus the law is verified.

Limitations of Demand Law

[edit | edit source]Law of Demand indicates the inverse relationship between price and quantity demanded of a commodity. It is generally valid in most of the situations. But there are some situations under which there may be direct relationship between price and quantity demanded of a commodity. These exceptions are known as exceptions to the law of demand.

- Consumer ignorance: Consumers ignorance induce them to buy/purchase more in the costly market. Sometimes they think like high price commodity is better in the quality. Thus with the increase in price, demand increases.

- Necessary Goods: There are some commodities which are not necessities/necessary but have become necessities because of their constant use and fashion. For example: LPG gas, Petrol, etc. Prices of such commodities increases, demand does not show any tendency to contract and it negatives the law.

- Conspicuous & consumption: If consumers measure the desired ability of the utility of a commodity, solely by its price and nothing else, then they tend to buy more of the commodity at higher price and less of it at lower price. Hence, there is a direct relationship between price & quantity demanded. For example: Gold ornaments, Diamonds, hair paintings.

- Higher the price of the good, greater will be the prestige of the buyer in the society and vice-versa. When price falls, the commodity comes within the reach of lower class people and they tend to demand more because of demonstration effect.

- Speculation: If people expect the price of good to rise in near future, they demand more even at higher price. And if they expect the price to fall in near future, they demand less of it even at lower price. Thus more quantity of goods is demanded at rising prices and less quantity of goods is demanded at falling prices. This seems contrary to law of demand.

- Giffen Goods: These are special type of inferior goods named after Sir Robert Giffen.

- According to him, when price of inferior goods increases, demand increases, & when price falls, demand falls. So there is direct relationship between price and demand.

- People increase preferences towards superior goods due to rise in their real income. This tendency is found in low class people. However if price increases beyond certain limit, naturally demand may fall as people prefer superior goods.

Elasticity of Demand

[edit | edit source]It refers to measure of responsiveness (elasticity) of demand to the change in any of the determinants of demand cet. par.

Elasticity of demand is a ratio of proportionate change in quantity demanded to the proportionate change in any of the determinants.

Definition: It is defined as percentage of proportional change in dependent variable result to change in an independent variable.

Demand usually varies with prices, but the extent of variation is not uniform in all the cases. In some cases, variation is extremely wide and some cases it is just nominal. And sometimes it may not be responsive.

Now to measure this responsiveness or extent of variation economists use the word "elasticity". In measuring elasticity of demand two variables are there: 1) Demand 2) Determinant

The term elasticity of demand is commonly referred as price elasticity of demand. This is a loose interpretation of term.

Logically elasticity of demand should measure responsiveness of demand for a commodity to changes in the variables confined to its demand function.

QdN = f (PN, PR, I, T, E, O)

Hence there are many kinds of elasticity of demand as it's determinants. Economist usually consider three important kinds of elasticity of demand: 1) Price 2) Income 3) Cross price elasticity

Price elasticity

[edit | edit source]- Responsiveness in quantity demanded of a commodity to a change in its price..

- It means change in quantity demanded as a result of change in price in commodity.

- It is the ratio of proportional change in quantity demanded to a given proportional change in its price.

- Hence it is defined as ratio of proportionate change in quantity demanded, to proportionate change in price of commodity, cet par.

Where, Q = Original demand P = Original price ΔQ = Change in demand ΔP = Change in price

ΔQ = Q2 - Q1 = change in quantity demand measured as difference between new demand & original demand ΔP = P2 - P1 = change in price measured as difference between new price & original price

Example:

| Price of Apples ($) |

Quantity Demanded (kgs) |

| 20 (P1) | 100 (Q1) |

| 21 (P2) | 96 (Q2) |

Because of inverse price & demand relationship, the coefficient of price elasticity of demand is usually -ve.

However economists report it as a positive number, for the sake of convenient comparison & analysis. Hence -ve symbol is ignored.

In the above example elasticity of demand is less than one. Hence by using above formula numerical coefficient of price elasticity can be measured from any searched given data. Depending upon proportional change involved in data on demand & price, one may obtain various numerical value of coefficient of price elasticity ranging from 0 to ∞.

Types of Price Elasticity

[edit | edit source]There are 5 types of price elasticity of demand: 1) Relatively Elastic Demand(e>1):: 1) Relatively Inelastic Demand (e<1):: 1) Unitary Elastic Demand (e=1):: 1) Perfectly Elastic Demand (e=∞):: 1) Perfectly Inelastic Demand (e=0)::