Financial Math FM/Options Strategies

In finance an option strategy is the purchase and/or sale of one or various option positions and possibly an underlying position.

Options strategies can favor movements in the underlying that are bullish, bearish or neutral. In the case of neutral strategies, they can be further classified into those that are bullish on volatility and those that are bearish on volatility. The option positions used can be long and/or short positions in calls and/or puts at various strikes.

Directional strategies

[edit | edit source]Bullish options strategies are employed when the options trader expects the underlying stock price to move upwards. Bearish options strategies are the mirror image of bullish strategies. They are employed when the options trader expects the underlying stock price to move downwards.

Spreads

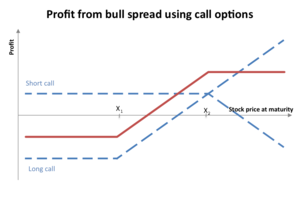

[edit | edit source]Bull call spread

[edit | edit source]A bull call spread is constructed by buying a call option with a low exercise price (K), and selling another call option with a higher exercise price.

Often the call with the lower exercise price will be at-the-money while the call with the higher exercise price is out-of-the-money. Both calls must have the same underlying security and expiration month.

Example

[edit | edit source]Take an arbitrary stock XYZ currently priced at $100. Furthermore, assume it is a standard option, meaning every option contract controls 100 shares.

Assume that for next month, a call option with a strike price of $100 costs $3 per share, or $300 per contract, while a call option with a strike price of $115 is selling at $1 per share, or $100 per contract.

A trader can then buy a long position on the $100 strike price option for $300 and sell a short position on the $115 option for $100. The net debit for this trade then is $300 - 100 = $200.

This trade results in a profitable trade if the stock closes on expiry above $102. If the stock's closing price on expiry is $110, the $100 call option will end at $10 a share, or $1000 per contract, while the $115 call option expires worthless. Hence a total profit of $1000 - 200 = $800.

The trade's profit is limited to $13 per share, which is the difference in strike prices minus the net debit (15 - 2). The maximum loss possible on the trade equals $2 per share, the net debit.

Bull put spread

[edit | edit source]A bull put spread is constructed by selling higher striking in-the-money put options and buying the same number of lower striking in-the-money put options on the same underlying security with the same expiration date. The options trader employing this strategy hopes that the price of the underlying security goes up far enough such that the written put options expire worthless.

Example

[edit | edit source]Take an arbitrary stock ABC currently priced at $100. Furthermore, assume again that it is a standard option, meaning every option contract controls 100 shares.

Assume that for next month, a put option with a strike price of $105 costs $8 per share, or $800 per contract, while a put option with a strike price of $125 is selling at $27 per share, or $2700 per contract.

A trader can then open a long position on the $105 strike put option for $800 and open a short position on the $125 put option for $2700. The net credit for this trade then is $2700 - 800 = $1900.

This trade will be profitable if the stock closes on expiry above $106. If the stock's closing price on expiry is $110, the $105 put option will expire worthless while the $125 put option will end at $15 a share, or $1500 per contract. Hence a total profit of $1900 - 1500 = $400.

The trade's profit is limited to $19 per share, which is equal to the net credit. The maximum loss on the trade is $1 per share which is the difference in strike prices minus the net credit (20 - 19).

Neutral or non-directional strategies

[edit | edit source]Neutral strategies in options trading are employed when the options trader does not know whether the underlying stock price will rise or fall. Also known as non-directional strategies, they are so named because the potential to profit does not depend on whether the underlying stock price will go upwards or downwards. Rather, the correct neutral strategy to employ depends on the expected volatility of the underlying stock price.

Examples of neutral strategies are:

- Guts - sell in the money put and call

- Butterfly - buy in the money and out of the money call, sell two at the money calls, or vice versa

- Straddle - holding a position in both a call and put with the same strike price and expiration. If the options have been bought, the holder has a long straddle. If the options were sold, the holder has a short straddle. The long straddle is profitable if the underlying stock changes value in a significant way, either higher or lower. The short straddle is profitable when there is no such significant move.

- Strangle - the simultaneous buying or selling of out-of-the-money put and an out-of-the-money call, with the same expirations. Similar to the straddle, but with different strike prices.

- Risk Reversal

Bullish on volatility

[edit | edit source]Neutral trading strategies that are bullish on volatility profit when the underlying stock price experiences big moves upwards or downwards. They include the long straddle, long strangle, short condor and short butterfly.

Bearish on volatility

[edit | edit source]Neutral trading strategies that are bearish on volatility profit when the underlying stock price experiences little or no movement. Such strategies include the short straddle, short strangle, ratio spreads, long condor and long butterfly.

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a large probability of earning a small limited profit when the future volatility of the underlying is expected to be different from the implied volatility.

Long butterfly

[edit | edit source]A long butterfly position will make profit if the future volatility is lower than the implied volatility.

A long butterfly options strategy consists of the following options:

- Long 1 call with a strike price of (X − a)

- Short 2 calls with a strike price of X

- Long 1 call with a strike price of (X + a)

where X = the spot price and a > 0.

Using put–call parity a long butterfly can also be created as follows:

- Long 1 put with a strike price of (X + a)

- Short 2 puts with a strike price of X

- Long 1 put with a strike price of (X − a)

where X = the spot price and a > 0.

All the options have the same expiration date.

At expiration the value (but not the profit) of the butterfly will be:

- zero if the price of the underlying is below (X − a) or above (X + a)

- positive if the price of the underlying is between (X - a) and (X + a)

The maximum value occurs at X (see diagram).

Short butterfly

[edit | edit source]A short butterfly position will make profit if the future volatility is higher than the implied volatility.

A short butterfly options strategy consists of the same options as a long butterfly. However all the long option positions are short and all the short option positions are long.

Variations of the butterfly

[edit | edit source]The double option position in the middle is called the body, while the two other positions are called the wings.

The option strategy where the middle two positions have different strike price is known as an Iron condor.

In an unbalanced butterfly the variable "a" has two different values.

References

[edit | edit source]- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed. ed.). New York : New York Institute of Finance. ISBN 0-7352-0197-8.

{{cite book}}:|edition=has extra text (help)

External links

[edit | edit source]- Butterfly Screener

- Long and Short Butterflies graphically illustrates component options in long and short butterflies.

- Butterfly Spreads - Spread Your Wings & Profit things you should know about Butterfly Spreads

- - Know More about Butterfly Option Trading Strategy via real trade example

References

[edit | edit source]- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed. ed.). Prentice Hall. ISBN 0-7352-0197-8.

{{cite book}}:|edition=has extra text (help)