Public-Private Partnership Policy Casebook/Higher Education

Overview

[edit | edit source]Introduction

[edit | edit source]Unlike the many high profile transportation projects that have been brought online through a public private partnership arrangement, the development of higher education facilities procured for public institutions with private participation has until fairly recently been mostly limited to moderately sized and single entities completed within a variety of procurement and legal options.

Although comprehensive analyses of public universities’ use of internal or independent non-profit vehicles for expanding their development resources are not readily available, there is ample evidence that foundations and other not for profit organizations have been utilized by public institutions for the purpose of enabling projects that could not be accommodated by either the capital plans, or the desired schedules.[1][2] Since 1995 these ventures have gradually expanded into variations of public private partnerships that have ranged from design build projects developed with public funding and minor risk transfer to larger and clustered projects that have transferred significant risk to the private partner, including financing and debt service of non-recourse loans based on projected revenue streams.

P3s allow universities to expand their facilities with minimal impact on the university’s balance sheet – although rating agencies are starting to scrutinize deals that are integral to campus strategic plans. If there is a probability that the institution may have to assume financial responsibility for a privately developed property under certain circumstances, the project may affect the school’s credit rating.[3]

Levels of Private Participation

[edit | edit source]Levels of private participation:[4]

- Operations and service contracts are often outsourced to private companies; control and criteria varies depending on specific contract stipulations.

- A non-profit foundation issues bonds to fund development and serves as the property owner until the debt is paid. Revenues are used to service debt, and subsequently allocated to other campus functions. The foundation model allows the university to protect its interests while shielding it from financial obligations.

- Institutions lease land to a for-profit company that invests their own equity to fund development. The method expedites construction, and has a lower impact on university finances; more control must be allocated to the private partner than to a foundation. The developer receives revenues from operations, and may transfer a percentage of the income to university if it exceeds the contract profit levels.

This report will analyze the development and operation of three projects representing three distinct uses, and are chosen because they appear to indicate a trajectory and trend in the use of public private partnerships by institutions of higher education:

Mixed-Use Project at University of California, Davis; Campus Parking Project for Ohio State University, Columbus Ohio; Student Housing Project for the University System of Georgia at nine of their member institutions

P3 Incentives

[edit | edit source]The incentives for bringing these projects online with P3 procurement are similar for all of these uses, and are summarized in a White Pater on Student Housing prepared by the Scion Group that can as easily be applied to auxiliary functions related to the needs of a student population:[5]

- Urgent needs, including greater-than-expected student enrollment, insufficient on-campus facilities or other special circumstances.

- Expedited schedule of the development process where state or internal requirements (procurement, standards and specifications) can result in a delivery process longer than that for a third-party developer, and higher costs.

- Experience and expertise from outside sources, particularly for institutions that have no existing student housing, or have not recently built new facilities. Because of the variety of partnership structures available, institutions can tailor them to their needs. For example, a school with more experience in operations and less in delivery may choose to focus on that need.

- Risk reduction, which is particularly attractive to schools with no track record of building these facilities on their campus.

- Preservation of debt capacity, such that other capital priorities can be accomplished.

- Maintaining a favorable balance sheet and credit treatment - although a formal partnership would not be entirely off-balance sheet for the institution.

Current State

[edit | edit source]The Economic Stimulus Act of 2009 paved the way for more public colleges to partner with private developers to keep up with demand for expanded facilities without taking on more debt. When the bonds are fully paid, the property will revert to the university. For many projects it is possible to take advantage of availability payments, and use multiple sources of financing in a multi-tranced capital structure. For certain types of assets, tax exempt financing can be incorporated with other private funding sources.

Among the more ambitious projects underway is The College of New Jersey’s Campus Town, a 12-acre mini village being built in partnership with the West Long Branch-based PRC Group. The development will house not only students, but retail outlets as well.[6]

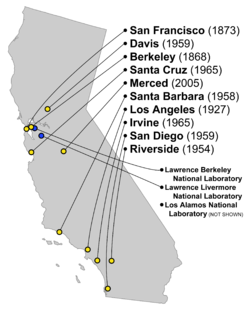

Several other state universities have recently initiated substantial projects under the expanded framework of a P3, like University of California, which has recently issued an RFQ for their Merced 2020 P3 development. Six major international developers submitted qualifications on 11/ 3, 2014, to the Regents of the University of California for what would be the “first major P3 at a University of California campus.”[7]

The UC has had several projects developed in tandem with private sponsors, and the qualifier of “first” in this news brief is obviously the classification as a major P3 as compared to other UC developments.

For the many benefits that can be reaped from a public private partnership framework there are numerous complications that, if not addressed from the beginning, can easily turn a promising venture into a regrettable condition with outrage over rising fees or rents, decreasing service, lack of transparency, legal challenges from unsuccessful bidders, and the ultimate failure of an aborted project that ends up wasting millions of dollars before getting off the ground.

Besides the internal functions of a collaboration, the P3 framework in and of itself brings demands to the process that can be a massive impediment to the use of this procurement method. Because of the complexity of concession agreements, negotiating terms can take months or years as each side attempts to identify problems that could occur over the often decades-long life of the project. The process has spurred an entire industry segment of consultants, and can at times rival or exceed the timelines for standard public procurement. Given the generally lower cost of public funding and the fact that the procurement cost for P3 transactions has typically been higher, the remaining reasons for proceeding with a P3 agreement would be the availability of private financing, the transfer of risk, and the assumed inherent efficiencies that the private sector can achieve – all of which would be affected by the economies of scale. The current trends would consequently indicate that the prospects of a successful P3 completion would increasingly become an option reserved for larger institutions that can bundle scope adequate to entice private operators to participate as equity investors. Even for university systems with robust financing capability the advantage of risk transfer would typically come in conjunction with a private equity agreement. The selected case studies of P3 uses in Higher Education indicate this trajectory.

Mixed-Use Project | UC Davis West Village Phase I

[edit | edit source]Summary

[edit | edit source]Background

UC Davis was founded in 1905 and as of fall 2013 enrolls approximately 34,000 students. These students have the choice between 102 undergraduate majors and 90 graduate programs. [8] Moreover, the annual research budget exceeds $500 million. The campus is located just west of the state capitol, Sacramento, and approximately 80 miles from San Francisco.[9]

Scope

The UC Davis West Village is an expansion project of the UC Davis main campus to build an innovative mixed-use community on university land adjacent to the main campus. The West Village was designed with three core principles in mind: housing availability, environmental responsiveness and quality of place.[10] The West Village is noteworthy because it is the largest net-zero community project of its kind in the United States.[11]

The complete plan for West Village comprises a total of 200 acres privately developed in two phases. The final community will accommodate for a total of 475 new homes for faculty/staff and housing for 3,000 students, which translates to housing options for approximately 4,350 people. Moreover, the final community includes 42,500 square feet of commercial space and a recreation center.[12]

This study focuses on the 130-acre Phase I of the West Village Project. Phase I includes 343 single-family homes for faculty/staff and 1,980 student apartments, as well as a village square surrounded by ground-floor commercial space and the Los Rios Community College District's new Davis Center. [13]

List of Actors

[edit | edit source]Schools

- UC Davis - the University

- The UC Board of Regents (BOR) - official approval and decision body for the University

- Sacramento City College - local community college district

- Los Rios Community College District - local community college to utilize the new Davis Center located in the West Village

Developer

- West Village Community Partnership, LLC (WVCP) a joint venture of:

- Carmel Partners - based in San Francisco, and is a national, full-service real estate investment company

- Urban Villages – based in Denver, and is a real estate investment company committed to industry-leading sustainable and responsible development

Design

- Civil Engineer: Cunningham Engineering

- Architecture: Lim Chang Rohling & Associates, MVE Institutional, Studio E Architects and SWA Group

Energy Partners

- Academic - numerous academic partners are involved in the West Village Energy Initiative, which was developed to ensure the success of the zero net energy strategy for West Village. Involved parties include, but are not limited to:

- The Institute of Transportation Studies at UC Davis (ITS-Davis)

- The UC Davis Biogas Energy Project

- The UC Davis California Lighting Technology Center

- Corporate - several business partners include, but are not limited to:

- Chevron Energy Solutions

- PG&E

- SunPower Corp.

Funding Agencies

- A number of federal and state grants were received in support of the West Village Energy Initiative and total nearly $7.5 million. These granting agencies include:

- California Energy Commission’s PIER Renewable-Based Energy Secure Community program

- U.S. Dept. of Energy’s Community Renewable Energy Deployment program

- California Energy Commission

- California Public Utility Commission's California Solar Initiative

Timeline of Events

[edit | edit source]| Date | Event |

|---|---|

| 2000 | Three-year planning process begins to update the campus’s Long Range Development Plan. The campus holds more than 30 public meetings in developing the plan. |

| November 2003 | The Neighborhood Master Plan is published for what will become UC Davis West Village. |

| August 2004 | A Request for Qualifications (RFQ) is issued. Four proposers are shortlisted and invited to provide detailed proposals. |

| March 2005 | UC Davis selects its development partner. |

| November 2006 | The UC BOR approves the business terms of the ground lease. |

| August 2008 | UC Davis signs the ground lease for the project. |

| August 2009 | Phase 1 groundbreaking. |

| December 2010 | Preleasing begins for student apartments for the 2011-12 school year. |

| May 2011 | Recreation building and first apartments are completed. |

| August 2011 | Students and staff begin moving in to The Ramble and Viridian apartments. |

| October 2011 | Official ribbon-cutting for Phase 1. |

| January 2012 | Sacramento City College Davis Center classes scheduled. |

Narrative

[edit | edit source]Financials and Contract details

In the beginning of the solicitation, two Request for Qualifications (RFQ) were issued for prospective development partners to help implement the Phase I of the project. One of the RFQs was for development of faculty and staff housing and the other one was for development of mixed-use student housing. Prospective developers were allowed to submit for either or both projects. [14]

From the RFQ evaluation, four developers are shortlisted following selection process and each was invited to provide detailed proposals. [15] During this proposal process, the two RFQs were combined into a single solicitation. From the detailed proposal evaluation, WVCP was selected as the concessionaire. With this decision the UC Davis vice chancellor for resource management and planning, John Meyer, explained the concessionaire “team has developed some fine examples of mixed-use urban development, similar in scale and form to what is envisioned at West Village" and the "West Village Community Partnership represents the sort of innovative and experienced leadership that will make the West Village neighborhood an asset to the campus and greater Davis community, and a true model for the region.” [16]

By using P3 methods, the university was able to conserve its capital resources for other uses, and its direct investment of $17 million is being leveraged to support a $280 million project. The development and implementation of UC Davis West Village is a collaboration between the university and a private developer, WVCP. [17]

The university will bring utilities to the edge of the complex and retains ownership of the land. WVCP is responsible for design, finance and construction of Phase 1 of West Village, including development and management of rental housing and the construction and sales of the single family homes. WVCP operates under multiple 65-year ground leases (retail and apartments) and 99-year ground leases (faculty housing). Furthermore, the campus and WVCP share responsibility for leasing the retail space in the development. The campus retains ownership of the land throughout the lease. [18][19]

Issues/Conflicts

The faculty-staff housing component was a driving factor for the development of the West Village Project. University needed a way to assist in recruiting and retaining top talent by enabling them to afford to live locally and participate fully in the community. Thus, UC Davis needed to ensure the West Village accomplished this goal and added to the Davis housing supply but also sold the homes at below-market prices.[20] This needed to be accounted for in the contractual ground lease terms because offering below market prices is not the preferred leasing strategy for a private concessionaire.

Phase I of the West Village Project had many inherent complexities due to several factors, including the many sustainable elements involved in the design and the large number of organizations involved in the deal. The sustainable design elements range from the orientation/layout of the apartment buildings to capture the nighttime cooling breezes from the Sacramento delta to solar panels on every building roof and on parking canopies. The solar photovoltaic system is in total 4 megawatts and generates enough electricity to meet all the annual needs of the residents. Sustainable elements even include a sophisticated power strip allowing residents to turn off individual outlets remotely using a smartphone, white roofs instead of black roofs on all buildings, and bike/transit friendly design enhancements to better connect the West Village with main campus.[21]

The number of organizations that came together to make the UC Davis West Village Project possible is impressive to say the least. The project had not one but two university systems involved: the UC Davis and Los Rios Community College District. The project is the first UC campus to build a community college branch in a University developed community.[22] The project also had four federal and state organizations who granted money, as well as a total of eleven energy partners, which included both academic research centers and corporate partners. Finally, the faculty and student body is a major stakeholder in this project that needed to be included. During the planning stages, the University held 30 public meetings to make sure the public voice was heard.

Parking Privatization Project | Ohio State University

[edit | edit source]Summary

[edit | edit source]In September of 2012, Ohio State University located in Columbus, Ohio, closed a car parking concession deal granting a $438 million upfront fee.[23] The University leased the 36,000 on-campus parking spaces to the private bidder Queensland Investment Corporation (QIC) for 50 years. The concessionaire is to manage the 36,000 spaces with over 13,000 spaces across 17 garages, and over 22,000 spaces on more than 150 surface lots with about 150 on street metered spaces throughout the main campus. The concessionaire will be permitted to increase meter rates at 5.5 percent per year for the first 10 years with the exception of the medical center, which is agreed to only increase three percent, and the greater of four percent or inflation each year thereafter. Though the lease is for 50 year Ohio State will still own its parking garages and lots.[24]

List of Actors

[edit | edit source]- Ohio State University Ohio State or OSU, is a public research university in Columbus, Ohio founded in 1870.

- QIC is an Australian state-owned pension manager. QIC will provide an equity investment and will be compensated through parking revenues.

- CampusParc manages and operates The Ohio State University parking facilities. CampusParc is an expert in parking. Our parking professionals have decades of experience managing parking facilities for universities, special events, and medical campuses across the country.

- Morgan Stanley American multinational financial services corporation headquartered in the Morgan Stanley Building, Midtown Manhattan, New York City. Morgan Stanley operates in 42 countries and has more than 1,300 offices and 60,000 employees.

- Jones Day is an international law firm. The firm currently has 41 offices worldwide and employs about 2,400 lawyers, making it the third largest law firm in the world.

- Desman Associates is a professional corporation with more than 100 professional and technical personnel. The firm is a leading national specialist in transportation improvements and the planning, design and construction administration of functionally efficient, attractive and cost effective parking facilities. Since the firm’s inception in 1973, DESMAN has served public, private and institutional Clients and Owners throughout the U.S. and abroad and has provided planning, design, and restoration services for over 1,500 parking projects.

Narrative

[edit | edit source]Financials and Contract details

The concessionaire raised $265 million through a term loan, and raised another $20 million through a capital expenditure (CapEx) facility. Both loans have an interest rate of LIBOR (London Interbank Offered Rate) plus 2.75 percent.

OSU spent more than 12 months researching a potential parking lease before deciding to take the first step of releasing a Request for Qualifications. The time was spent understanding every aspect of the parking system and how it might work under a potential leasing arrangement. In addition, The University also engaged experienced advisors, such as Morgan Stanley, Jones Day and Desman Associates, who have each worked on a variety of similar transactions. They were able to assist us in learning from the experiences of other organizations, including the city of Chicago. Given the unfortunate events of the Chicago P3 deal OSU made provisions that in the event of a cancellation occurring because of a default by the vendor, the university would keep the upfront money. If the contract was cancelled because of a default by Ohio State, then the University could be required to pay back a portion. A default by a vendor that resulted in canceling the contract could have actually been a positive for the University’s credit rating, since OSU would be allowed to keep the upfront payment but If OSU was required to pay back some portion of the upfront proceeds, then there could be a credit rating impact. This deal is one of many funding solutions that would allow OSU to take on less debt in the future and still fund the University’s core mission.

Unlike Chicago, money generated from any such lease the University entered into would go directly into their long-term investment pool. It would not be used for one-time spending. The interest earned would provide continual funding for teaching, student support, arts and humanities, and campus transportation improvements. One way to protect the funds would be to set up four distinct endowment funds for the areas above. Any changes to the specific funds would require a Board of Trustees resolution. Also, in Chicago, there were no caps on rate increases so the leasing operating was able to increase rates by 400 percent immediately. The University proposal kept rate increases in line with historical university increases. Another added contractual benefit for the University is that there is a bank of 2,200 spaces the University could reduce as necessary, without penalty, if OSU needed to close or remove parking spots because of construction or changes to the campus layout.

Issues/Conflicts

The University faced a number of challenges the main challenge being the first US university to ever agree to lease its parking spaces. This deal was deemed risky primarily due to a generally negative perception of parking concession agreements resulting after a 2009 $1.15 billion deal for the Chicago Parking Meters System fell through. The Chicago parking deal left city residents angered over the fact that parking rates had skyrocketed and more over, that the city still faced a huge budget deficit. The Chicago deal was not the only thing to smudge to reputation of Parking P3 deals. P3 dealmakers were also deeply discouraged by the fact that that both the city of Los Angeles and Pittsburgh abruptly cancelled P3s for their parking meter system. The cancellation was largely due to political issues but regardless the financial hits taken deterred many dealmakers. A deal by New Jersey Transit to lease the parking spots at its commuter stations has been in limbo for a good number of years adding to the poor reputation Parking P3s have.[25]

Students, faculty and staff were deeply worried about the rise in parking rates as well as the wide range of service the University provided. OSU made certain that the company could not raise rates more than 7.5 percent annually for the first 10 years, which is the average amount that rates increase for the 12 years previous to the finalizing of the deal. That cap is built into the resolution authorizing the lease. Rates increased an average of 5.6 percent in the 10 years and 4.5 percent in the five years before 2012. OSU also required the vendor QIC to agree to a broad range of service standards covering everything Transportation & Parking did to support parking. This included services offered for battery jumps, flat tires, running out of gas, etc. The contract included the use of customer feedback and contract performance reviews to monitor operator performance.[26]

QIC manages the parking operations with their own staff. This proposed a potential risk for Transportation & Parking employees so OSU gave the option of interviewing with the chosen vendor, and if offered a position, could make the choice based on whatever information the vendor provides regarding salary and benefits. But, if they wanted to stay on at Ohio State, the University helped them find jobs within the university so that they may remain university employees, with university benefits.[27]

Student Housing Project | University System of Georgia

[edit | edit source]Summary

[edit | edit source]The trend in P3 usage for Higher Education is towards larger concessions with independent financing arranged by the concessionaire, and more risk transferred from the public side. Optimal conditions could allow for control over essential functions being retained by the public partner whose services would be reimbursed through the concession agreement. One of the most ambitious efforts to maximize benefits by clustering scope is evident in the very recent procurement by the University System of Georgia (USG) for maintaining and operating a substantial part of their housing stock on nine campuses, and expanding the number of available beds by 60% with new on-campus construction and development.

USG announced on November 12th this year that an agreement had been reached with Corvias Campus Living for a $517 million agreement to develop 3,683 new beds and manage 6,195 existing beds of on-campus housing for nine out of thirty-two member institutions within the University System for the next 65 years. The new beds are scheduled to be ready for students in fall 2016. The previously published conditions of the procurement show the agreements running for thirty years after July 1st 2015, but the extended concession period may have been a negotiated change to allow the private sponsor more time to recover substantial up-front financing to meet USG’s extensive requirements. The initiative is expected to help maintain the affordability of housing for students, and improve the fiscal health of the University System by providing financial tools and resources while reducing student-housing debt by nearly $300 million. As quoted from Chancellor Hank Huckaby’s announcement: “Quality, safe, affordable housing for students is our priority; we expect our initiative will generate innovation, operating efficiencies, and best practices in student housing to improve the quality of the on-campus housing experience for our students.” “We are always looking at ways to keep costs down and still provide a quality education and student services, and the Public-Private Partnership initiative will help keep the cost of student housing provided by our colleges and universities low and affordable.”[28]

The participating campuses are: Abraham Baldwin Agricultural College, Armstrong State University, College of Coastal Georgia, Columbus State University, Dalton State College, East Georgia State College, Georgia Regents University, Georgia State University and the University of North Georgia.

Narrative

[edit | edit source]Financials and Contract Details

A summary of the details from USG’s website lists the following metrics and conditions of the contract:

An innovative direct lending approach will offer benefits such as:

- Initial $325 Million payment to USG toward defeasance of existing housing bonds

- $10 Million payment of prepaid base rent

- $164 Million for new construction of 3,683 beds.

- More funds available for development by the elimination of Debt Service Reserve Fund

- Approximately $518 Million in private capital to be provided by institutional lenders

- $5.6 million upfront investment in deferred maintenance

- Closing and construction start is set for July 1, 2015 with $ 325 M payable on that date, and liquidated damages in the amount of $ 25 M being assessed if the closing does not take place

- Completion of each proposed new student housing project to occur no later than July 15 2016, or liquidated damages will be assessed.

- Capital Repair and Replacement Fund will be covered in excess of $230 Million; housing will be returned in like-new condition at lease-end

- Guaranteed annual base rent based on percentage of the gross revenue. (These percentages and the relative threshold when they kick in constitute the financial competitive part of the procurement while the defeasance coverage and prepaid base rent were direct stipulations of the contract that every submitter had to include by given sums)

- Rental payments to BORs and Institutions in the amount of $3.7 Billion are projected based on anticipated revenue. Contingent Rent is projected to be in excess of $2 Billion

- The guaranteed annual base rent will be affected by the performance of the concessionaire, such that regular surveys showing less than satisfactory operations will result in a percentage increase of the base rent based on gross revenue.

- The agreement provides flexibility for unforeseen conditions

- USG will approve designs and specifications, and have oversight over development processes through third party consultants

It is difficult to predict the ultimate success of this initiative inasmuch as the solicitation has gone no further than to the Commercial Closing, and the Financial Closing and Notice to Proceed are more than seven months away. The contract is so expansive and yet so diversified that the procurement is certain to set a precedent for many other institutions that will likely be keen observes of developments ahead.

Issues/Conflicts

According to real estate analysts who have labeled the agreement unprecedented, what makes this deal so special is that it is the first time a state university system has initiated the privatization of student housing through a portfolio of campuses.[29]

Each campus agreement will be tailored to the needs and goals of the individual institutions, but USG will retain oversight of the campus-housing partnership and have a governance process in place. Some institutions within the system that are not yet included in the P3 agreement have had students voicing concern over the long term effects of the measure if their schools should later become a party to the overall contract, notably at Georgia Tech. While USG has not yet announced if Tech will join the privatization plan, Tech President G.P. Peterson says that he is not worried about an ill effect on Tech as a result. “I do have confidence that the USG will work with us to identify and establish a plan that will be in the best interest of the students, faculty and staff”. Common issues have been the possibility of rent hikes if the existing caps should be increased from their current annual level of 3 %.

One of the most controversial parts of the P3 plan was the Georgia statewide referendum that made the bill possible. Proposition 1, which appeared on Georgia ballots on November 4th, gives Corvias a tax exemption for operating USG-owned property. Critics of the measure, including Sen. Mike Crane (R-Newnan), who voted against the referendum in the Georgia Senate, say that the proposition gives an unfair advantage to corporations running USG-owned property over those running private apartments off-campus.[30][31] The result means that private developers building and/or managing the state schools’ properties and parking decks will not have to pay property taxes on the buildings included in the partnership.[32] Another common criticism of Proposition 1 is that the wording was confusing and that many voters, including students, were not properly educated on the effect of the measure. Considering that the plans for a P3 engagement had barely been discussed before December of 2013 when presidents of individual institutions were circulating general information in the their updates to faculty and staff, it is not surprising that students were taken off guard.

Robert G. Boehmer, President of East Georgia State College relayed the following in his overview of pending plans and top priorities for 2014: “Simply put, the College's ability to expand enrollment is dependent, in large part, on the availability of adequate student housing, and our financial health depends in significant part on our ability to expand enrollment. During spring, working with the USG to finalize new student housing plans is a priority. Our current residence halls were built using a PPV (public private venture). We have been working aggressively with the USG on a new approach to residence hall funding known as P3 (public private partnership). This initiative has been approved in concept by the BOR for the entire USG, and I anticipate, but am not certain, that it will be finally approved soon."[33]

Under the P3 initiative, instead of a public issuance of tax exempt bonds to finance construction as was done with the PPV, private developers will build new student housing at a number of USG institutions and will acquire some existing student housing at those institutions. All of this will be done with the private placement taxable bond sale proceeds (which are off balance sheet and credit positive as to the University System of Georgia). The housing built or acquired by the private developers will then be operated by the private developer under a long term agreement with the institution of higher education. As designed, the residence halls would run on a day to day basis much as they do now (e.g., our housing personnel would run the residence halls and our police officers would patrol the residence halls, etc.). However, the financial risk would be on the developer. Boehmer also noted “I am extremely hopeful (but not yet certain) that this P3 initiative will add 200 beds of capacity to EGSC's student housing in the near future.” The positive outlook for the coming improvements is still warranted as shown in the below captioned timeline.

The final agreement announced on November 12, 2014, was the result of a procurement process that was remarkable, not only for its extensive and diversified scope, but also for its compact schedule that is still current after its first publication during last spring. The BOR announced in September that Corvias Campus Living and two other competitors had been selected as prequalified bidders. Five more entities submitted, and even though they were not selected to go forward, they provided a solid foundation for a competitive solicitation that could be robust enough to withstand a potential protest. No legal challenge has been announced to date.

Timeline of Events

[edit | edit source]| Date | Event |

|---|---|

| April 2014 | Request for Qualified Contrators (RFQC) issued. |

| June 2014 | RFQC reponses due. |

| July 2014 | Shortlist announced and draft RFP issued to shortlisted proposers. |

| August 2014 | Campus tours conducted and one-on-one discussions held. |

| September 2014 | Preliminary pricing due and one-on-one negotiations conducted with shortlisted proposers. |

| October 2014 | Final RFP issued and Board of Regents (BOR) and Foundations approve the general terms of the transaction. Final RFP responses due. |

| November 2014 | Referendum on Ad Valorem property tax exemption. BOR approval of chosen concessionaire. Issuance of Notice of Intent to Award. Commercial close. |

| July 2015 | Transition of existing housing from the BOR to the concessionaire. Financial Close. Notice to Proceed. |

| July 2016 | Construction completion and occupancy begins. |

List of Actors

[edit | edit source]Board of Regents (BOR) is the governing body for the University System of Georgia. The Board elects a chancellor who serves as its chief executive officer and the chief administrative officer of the University System.

Jones Lang LaSalle (JLL) has been retained by BOR to be its exclusive agent and consultant in assisting in the procurement of the Concessionaire and structuring the relationship. JLL (NYSE:JLL) is a financial and professional services firm specializing in real estate.

Wells Fargo Securities, LLC, (WFS) has been retained by JLL to provide certain financial analysis relating to the transaction. Wells Fargo Securities, LLC, will not be engaged as underwriter of any debt security issued in connection with this transaction; however, Wells Fargo Bank, N.A., may participate as a lender in a transaction resulting from this RFQC.

Corvias Campus Living, LLC, (CCL) was selected by the BOR as a campus-housing partner for the initial phase of USG's P3 initiative. CCL is part of Corvias Group, a fully integrated development, construction, and property management firm with expertise in public-private partnerships.

Discussion Questions

[edit | edit source]- Could more risk have been transferred to the concessionaire in the UC Davis West Village Phase I Project? Or would this risk have hindered the university's control over the community?

- The scope of the UC Davis West Village Phase I Project morphed during the solicitation process. In your opinion, should the university do more up front work to more clearly define the scope before solicitation?

- Will the popularity of OSU’s football games aid in Campus Parc’s revenue?

- Is leasing Ohio State University’s parking for 50 years is too long a period?

- Could the success of this project restore the reputation of P3’s in parking?

- What information would you deem adequate for the statewide referendum on property tax exemptions for private concessionaires doing business with the University System of Georgia if you were a resident of that state?

- If you were a student at a member institution of the University System of Georgia what would be your concerns about privatization of the campus housing facilities?

- What criteria would weigh the most in your selection of housing during your years of study?

Additional Readings

[edit | edit source]- ASCE Outside the Budget Box—Public/Private Partnership as a Creative Vehicle for Finance and Delivery of Public School Facilities: http://dx.doi.org/10.1061/(ASCE)1052-3928(2005)131:4(292)

- Public Works Financing, U.S. Social Infrastructure P3 Roundup, reprinted May-August 2012: (http://www.pwfinance.net/document/research_reprints/-1%20Social%20infrastructure.pdf)

- Hanson Bridgett Public Policy Forum p3 Projects at University Campuses: http://www.hansonbridgett.com/Publications/pdf/~/media/Files/Publications/P3-Projects-University-Campuses.pdf

- Private Public Partnerships at the University of California: http://www.ucop.edu/real-estate-services/_files/documents/ppp_at_uc.pdf

- Public-Private Partnerships: Alternative Procurement Methods for Campus Development in the University of California System A Bay Area Council Economic Institute White Paper, June 2010: http://www.bayareaeconomy.org/media/files/pdf/UCAlternativeInfrastructureWhitePaper.pdf

- University of Michigan P3 Parking : http://facultysenate.umich.edu/faa/faa12-19-12.pdf

- University of Michigan decision not to move forward with P3: https://record.umich.edu/articles/university-decides-not-move-ahead-leasing-parking-facilities

- Georgia House Declines to Vote on Broad P3: http://www.mondaq.com/unitedstates/x/302986/Building+Construction/Georgia+House+Declines+to+Vote+on+Broad+P3+Legislation

- Georgia SB 255: http://www.legis.ga.gov/legislation/en-US/display/20132014/SB/255

References

[edit | edit source]- ↑ Anne Gentry, Assistant Attorney General, GMU PUBP 714 Presentation 11-12-2014

- ↑ Tom Calhoun VP Facilities, GMU, Interview 11-11-2014

- ↑ Education Advisory Board Company, June 11 2010, Anne Lewandowski, Keely Bielat http://www.etsu.edu/125/documents/Replenishing%20Housing%20Stock%20through%20Public-Private%20Partnerships.pdf

- ↑ Education Advisory Board Company, June 11 2010, Anne Lewandowski, Keely Bielat http://www.etsu.edu/125/documents/Replenishing%20Housing%20Stock%20through%20Public-Private%20Partnerships.pdf

- ↑ The Scion Group LLC, 2010, Bronstein, Taylor, Samuels http://www.thesciongroup.com/pdf/scion_whitepaper2.pdf

- ↑ The Star-Ledger, Tom De Poto, 2014 http://www.nj.com/business/index.ssf/2014/03/colleges_expand_housing_options_through_public-private_partnerships.html

- ↑ UC Merced RFQ 2010 http://www.ucmerced.edu/rfp-rfq/request-qualifications-comprehensive-development-uc-merced-2020-project

- ↑ http://www.ucdavis.edu/about/facts/index.html

- ↑ Newswire. (May 2011). SunPower Corporation - UC Davis West Village Rising as the Largest Planned Zero Net Energy Community in the U.S.

- ↑ http://westvillage.ucdavis.edu/

- ↑ Witkin, Jim. (October 2011). Beyond Green: A Net-Zero College Community. New York Times. http://green.blogs.nytimes.com/2011/10/21/beyond-green-a-net-zero-college-community/?_r=0

- ↑ Witkin, Jim. (October 2011). Beyond Green: A Net-Zero College Community. New York Times. http://green.blogs.nytimes.com/2011/10/21/beyond-green-a-net-zero-college-community/?_r=0

- ↑ UC Davis News and Information.Construction Starts at UC Davis' West Village; Grant Supports Goal of 'Zero Net Energy' Community. http://news.ucdavis.edu/search/news_detail.lasso?id=9192

- ↑ UC Davis News and Information.Development Partners Sought for New Neighborhood. http://news.ucdavis.edu/search/news_detail.lasso?id=7111

- ↑ http://westvillage.ucdavis.edu/about/project-timeline.html

- ↑ UC Davis News and Information.UC Davis Selects Partner to Develop First Phase of West Village Neighborhood. http://news.ucdavis.edu/search/news_detail.lasso?id=7300

- ↑ http://westvillage.ucdavis.edu/partnership/index.html

- ↑ Public-Private Partnerships: Alternative Procurement Methods for Campus Development in the University of California System A Bay Area Council Economic Institute White Paper, June 2010

- ↑ http://westvillage.ucdavis.edu/partnership/index.html

- ↑ UC Davis New and Information. University, Developer Sign Ground Lease for West Village. http://news.ucdavis.edu/search/news_detail.lasso?id=8772.

- ↑ Dolan, Kerry. (October 2011). Largest U.S. 'Zero Net Energy' Community Opens In California At UC Davis. Forbes. http://www.forbes.com/sites/kerryadolan/2011/10/14/largest-u-s-zero-net-energy-community-opens-in-california-at-uc-davis/

- ↑ UC Davis News and Information. (September 2007). Los Rios to Build Community College Center at UC Davis: UC Regents OK Ground Lease for West Village Development. http://news.ucdavis.edu/search/news_detail.lasso?id=8329

- ↑ RICHARD, PÉREZ-PEÑA. “Ohio State Gets $483 Million Bid for Parking Lease.” News. New York Times, June 4, 2012. http://www.nytimes.com/2012/06/05/us/ohio-state-gets-483-million-bid-for-parking-lease.html?_r=0.

- ↑ “CampusParc,” n.d. http://www.campusparc.com/

- ↑ Matthew, Deery. “EFR.” EFR PERSPECTIVES: P3 FOCUS, June 2013. http://efr.pbworld.com/publications/default.aspx?id=26.

- ↑ 2012 OSU Evaluation of proposals http://www.osu.edu/parkingproposal/faqs.html

- ↑ 2012 OSU Evaluation of proposals http://www.osu.edu/parkingproposal/faqs.html

- ↑ USG P3 Solicitation 2014. http://www.usg.edu/fiscal_affairs/p3/rfqc

- ↑ Globe Street, LeClaire, 11-21-2014 http://www.globest.com/news/12_993/atlanta/student_housing/An-Unprecedented-P3-Student-Housing-Model-352774.html

- ↑ Technique, Marino, 11-14-2014, USG begins new plan to privatize housing http://nique.net/news/2014/11/14/usg-begins-new-plan-to-privatize-housing

- ↑ Ballotpedia, Georgia Proposition 1, 11-04-2014 http://ballotpedia.org/Georgia_2014_ballot_measures

- ↑ AxioMetrics Inc., Simonpietri, 11-05-2014 http://www.axiometrics.com/blog/student-housing-wins

- ↑ Robert G. Boehmer, President East Georgia State College update to College community. 12/2013. http://www.ega.edu/images/uploads/Presidents_update_12202013_%283%29.pdf