Social Statistics/pri

An Introduction to Social Statistics

[edit | edit source]The children of rich parents usually grow up to be rich adults, and the children of poor parents usually grow up to be poor adults. This seems like a fundamental fact of social life, but is it true? And just how true is it? We've all heard stories of poor persons who make it rich (Oprah Winfrey, Jennifer Lopez, Steve Jobs) and rich persons who spend all their money and end up poor. The relationship between parents' income and children's income for a random sample of Americans is depicted in Figure 1-1. As you can see, parents' income and children's income are related, but with plenty of room for error. Rich parents tend to have rich children, but not all the time, and poor parents tend to have poor children, but not all the time. This kind of result is very common in the social sciences. Social science can explain a lot of things about our world, but it never explains them perfectly. There's always room for error.

The goal of social statistics is to explain the social world as simply as possible with as little error as possible. In Figure 1-1, it seems like parents' incomes explain their children's incomes pretty well, even if not perfectly. Some of the error in explaining children's incomes might come from errors in measurement. Persons don't always answer honestly when asked how much money they make. Persons might not even know for sure exactly how much money they made in any given year. It's impossible to predict the mistakes persons will make in answering social survey questions about their incomes, so no analysis of children's reported incomes will be perfectly accurate.

On the other hand, most of the error in Figure 1-1 probably has nothing to do with bad measurement. Most of the error is in explaining children's incomes probably comes from important determinants of income that have been left out of this analysis. There are many potential reasons why children's incomes may not correspond to their parents' incomes. For example, potential sources of error include things like:

- Children may do better / worse in school than their parents did

- Children may enter more / less well-paying professions than their parents did

- Children may be more / less lucky in getting a job than their parents were

- Children may be more / less ambitious than their parents were

A statistical analysis of income that included children's school performance, choice of profession, job luck, and ambition would have less error than the simple graph based just on parents' income, but it would also be much more complicated. Social statistics always involves trade-offs like this between complexity and error. Everything about the social world is determined by many different factors. A person's income level might result in part from job advice from a friend, getting a good recommendation letter, looking good on the day of an interview, being black, being female, speaking English with a strong accent, or a million other causes. Social statistics is all about coming up with ways to explain social reality reasonably well using just a few of these causes. No statistical model can explain everything, but if a model can explain most of the variability in persons' incomes based on just a few simple facts about them, that's pretty impressive.

This chapter lays out some of the basic building blocks of social statistics. First, social statistics is one of several approaches that social scientists use to link social theory to data about the world (Section 1.1). It is impossible to perform meaningful statistical analyses without first having some kind of theoretical viewpoint about how the world works. Second, social statistics is based on the analysis of cases and variables (Section 1.2). For any variable we want to study (like income), we have to have at least a few cases available for analysis—the more, the better. Third, social statistics almost always involves the use of models in which some variables are hypothesized to cause other variables (Section 1.3). We usually use statistics because we believe that one variable causes another, not just because we're curious. An optional section (Section 1.4) tackles the question of just how causality can be established in social statistics.

Finally, this chapter ends with an applied case study of the relationship between spending on education and student performance across the 50 states of the United States (Section 1.5). This case study illustrates how theory can be applied to data, how data are arranged into cases and variables, and how independent and dependent variables are causally related. All of this chapter's key concepts are used in this case study. By the end of this chapter, you should have all the tools you need to start modeling the social world using social statistics.

1.1: Theory and Data

[edit | edit source]Theories determine how we think about the social world. All of us have theories about how the world works. Most of these theories are based on personal experience. That's alright: Isaac Newton is supposed to have developed the theory of gravity because he personally had an apple fall on his head. Personal experience can be a dangerous guide to social theory, since your experiences might be very difference from other persons' experiences. It's not a bad place to start, but social science requires that personal experiences be turned into more general theories that apply to other persons as well, not just to you. Generalization is the act of turning theories about specific situations into theories that apply to many situations. So, for example, you may think that you eat a lot of junk food because you can't afford to eat high-quality food. This theory about yourself could be generalized into a broader theory about persons in general:

- Persons eat junk food because they can't afford to eat high-quality food.

Generalization from personal experience is one way to come up with theories about the social world, but it's not the only way. Sometimes theories come from observing others: you might see lots of fast food restaurants in poor neighborhoods and theorize that persons eat junk food because they can't afford to eat high-quality food. Sometimes theories are developed based on other theories: you might theorize that all persons want to live as long as possible, and thus conclude that persons eat junk food because they can't afford to eat high-quality food. Sometimes ideas just pop into your head: you're at a restaurant drinking a soda with unlimited free refills, and it just dawns on you that maybe persons eat junk food because they can't afford to eat high-quality food. However it happens, somehow you conceive of a theory. Conceptualization is the process of developing a theory about some aspect of the social world.

The main difference between the kinds of social commentary you might hear on radio or television and real social science is that in social science theories are scrutinized using formal statistical models. Statistical models are mathematical simplifications of the real world. The goal of statistical modeling is to explain complex social facts as simply as possible. A statistical model might be as simple as a graph showing that richer parents have richer children, as depicted in Figure 1-1. This graph is takes a very complex social fact (children's income) and explains it in very simple terms (it rises as parents' income rises) but with lots of room for error (many children are richer or poorer than their parents).

Social scientists use statistical models to evaluate different theories about how the world works. In our minds we all have our own theories about the social world, but in the real world we can't all be right. Before social scientists accept a theory, they carefully evaluate it using data about the real world. Before they can be evaluated, theories have to be turned into specific hypotheses about specific data. Operationalization is the process of turning a social theory into specific hypotheses about real data. The theory that persons eat junk food because they can't afford to eat high-quality food seems very reasonable, but it's too vague to examine using social statistics. First it has to be operationalized into something much more specific. Operationalization means answering questions like:

- Which persons eat junk food? All persons in the world? All Americans? Poor Americans only?

- What's junk food? Soda? Candy? Potato chips? Pizza? Sugar cereals? Fried chicken?

- What's high-quality food? Only salads and home-made dinners? Or do steaks count too?

- Is fresh-squeezed fruit juice a junk food (high in sugar) or a high-quality food (fresh and nutritious)?

- What does "afford" mean? Literally not having enough money to buy something? What about other expenses besides food?

- Whose behavior should we study? Individuals? Families? Households? Whole cities? Counties? States? Countries? The world?

For example, one way to study the relationship between junk food consumption and the affordability of high-quality food is to use state-level data. It can be very convenient to study US states because they are similar in many ways (they're all part of the same country) but they are also different enough to make interesting comparisons. There is also a large amount of data available for US states that is collected and published by US government agencies. For example, junk food consumption can be operationalized as the amount of soft drinks or sweetened snacks consumed in the states (both available from the US Department of Agriculture) and affordability can be operationalized using state median income. Most persons living in states with high incomes should be able to afford to eat better-quality food.

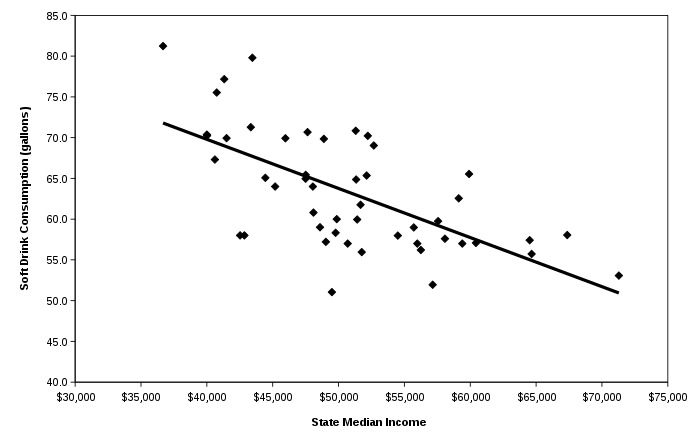

Data on state soft drink consumption per person and state median income are graphed in Figure 1-2. Each point in Figure 1-2 represents a state. A few sample states are labeled on the graph. This graph is called a scatter plot. Scatter plots are very simple statistical models that depict data on a graph. The scatter plot can be used to determine whether soft drink consumption rises, falls, or stays the same across the range of state income levels. In the scatter plot graphed in Figure 1-2, soft drink consumption tends to fall as income rises. This is consistent with the theory that persons buy healthy food when they can afford it, but eat unhealthy food when they are poorer. The theory may or may not be correct. The scatter plot provides evidence in support of the theory, but it does not conclusively prove the theory. After all, there may be many other reasons why soft drink consumption tends to be higher in the poorer states.

There is also a lot of error in the statistical model explaining soft drink consumption. There are many poor states that have very low levels of soft drink spending as well as many rich states that have very high levels of soft drink spending. So while the overall trend is that richer states have lower spending on soft drinks, there are many exceptions. This could be because the theory is wrong, but it also could be because there are many reasons why persons might consume soft drinks besides the fact that they are poor. For example, persons might consume soft drinks because:

- They live in places with hot weather and consume a lot of all kinds of drinks

- They eat out a lot, and tend to consume soft drinks at restaurants

- They're trying to lose weight and are actually consuming zero-calorie soft drinks

- They just happen to like the taste of soft drinks

All these reasons (and many others) may account for the large amount of error in the statistical model graphed in Figure 1-2.

Another way to operationalize the theory that theory that persons eat junk food because they can't afford to eat high-quality food is presented in Figure 1-3. In Figure 1-3, junk food consumption is operationalized as consumption of sweetened snack foods (cookies, snack cakes, candy bars, and the like). Again, the overall theory is that persons eat junk food because they can't afford to eat high-quality food, so state average income should be negatively related to the consumption of sweetened snack foods. In other words, as state average income goes up, sweetened snack food consumption should go down. But the data tell a different story: it turns out that there is essentially no relationship between state average income and sweetened snack consumption.

What went wrong here? Why is there no relationship between state average income and sweetened snack consumption? There are many possible reasons.

First, it may have been wrong to generalize from one person's experience (I eat junk food because I can't afford to eat high-quality food) to a general rule about society (persons eat junk food because persons can't afford to eat high-quality food). Second, it may have been wrong to conceptualize any relationship between affordability and junk food consumption at all (maybe junk food is actually more expensive than high-quality food). Third, it may have been wrong to operationalize junk food consumption at the state level (for example, it is possible that rich states actually contain lots of poor persons who eat lots of sweetened snacks). Fourth, it may have been wrong to use such a simple statistical model as a scatter plot (later chapters in this book will present much more sophisticated statistical models).

Because there are so many possible sources of error in social statistics, statistical analyses often lead to conflicting results like those reported in Figure 1-2 and Figure 1-3. Inconsistent, inconclusive, or downright meaningless results pop up all the time. The social world is incredibly complicated. Social theories are always far too simple to explain it all. Social statistics give us the opportunity to see just how well social theories perform out in the real world. In the case of our theory that persons eat junk food because they can't afford to eat high-quality food, social statistics tell us that there is some evidence to support the theory (soft drink consumption tends to be higher in poor states), but better theories are clearly needed to fully explain differences in persons' junk food consumption.

1.2: Cases and Variables

[edit | edit source]As the junk food example shows, when operationalizing theories into specific hypotheses in the social sciences the biggest obstacle is usually the difficulty of getting the right the data. Few quantitative social scientists are able to collect their own data, and even when they do they are often unable to collect the data they want. For example, social scientists who want to study whether or not persons can afford to buy high-quality food would ideally want to know all sorts of things to determine affordability. They would want to know persons' incomes, of course, but they would also want to know how much healthy foods cost in each person's neighborhood, how far persons would have to drive to get to a farm store or organic supermarket, whether or not they have a car, how many other expenses persons have besides food, etc. Such detailed information can be very difficult to collect, so researchers often make do with just income.

It is even more difficult to find appropriate data when researchers have to rely on data collected by others. The collection of social data is often done on a very large scale. For example, most countries conduct a population census at regular intervals. In the United States, this involves distributing short census questionnaires to over 100 million households every ten years. The longer, more detailed American Community Survey is sent to around 250,000 households every month. A further 60,000 households receive a detailed employment survey, the Current Population Survey. Other social data can also be very difficult and expensive to collect. The income data used in Figure 1-2 come from a national survey of 12,686 persons and their children who were surveyed almost every year for thirty years. The food consumption data used in Figures 1-2 and 1-3 come from barcode scans of products bought by 40,000 households across America. Obviously, no one person can collect these kinds of data on her own.

The good news is that enormous amounts of social survey and other social data can now be downloaded over the internet. All the data used in this textbook are freely available to the public from government or university websites. These public use datasets have been stripped of all personally identifying information like the names and addresses of individual respondents. Also very conveniently, the data in these datasets have usually been organized into properly formatted databases.

Databases are arrangements of data into variables and cases. When persons are interviewed in a survey, the raw data often have to be processed before they can be used. For example, surveys don't usually ask persons their ages, because (believe it or not) persons often get their ages wrong. Instead, survey takers ask persons their dates of birth. They also record the date of the survey. These two dates can then be combined to determine the respondent's age. The respondent's age is a sociologically meaningful fact about the respondent. Raw data like the respondent's birth date and interview date have been transformed into a variable that can be used in statistical models.

Variables are analytically meaningful attributes of cases. Cases are the individuals or entities about which data have been collected. Databases usually include one row of data for each case. Variables are arranged into columns. There may also be columns of metadata. Metadata are additional attributes of cases that are not meant to be included in analyses. A sample database including both metadata and variables is presented in Figure 1-4.

| STATE_NAME | STATE_ABBR | MED_INCOME | LB_SNACKS | GAL_SODA | LB_FRUVEG | |

|---|---|---|---|---|---|---|

| Alabama | AL | $40,751 | 111.6 | 75.5 | 168.3 | |

| Arizona | AZ | $49,863 | 109.0 | 60.0 | 157.0 | |

| Arkansas | AR | $40,001 | 104.3 | 70.4 | 147.3 | |

| California | CA | $58,078 | 105.7 | 57.6 | 201.8 | |

| Colorado | CO | $57,559 | 109.2 | 59.8 | 159.2 | |

| Connecticut | CT | $64,662 | 131.5 | 55.7 | 188.1 | |

| Delaware | DE | $56,252 | 134.6 | 56.2 | 218.2 | |

| District of Columbia | DC | $50,695 | 122.0 | 57.0 | 218.2 | |

| Florida | FL | $48,095 | 104.4 | 60.8 | 168.8 | |

| Georgia | GA | $51,673 | 107.1 | 61.8 | 198.4 | |

| Idaho | ID | $49,036 | 130.0 | 57.2 | 185.3 | |

| Illinois | IL | $52,677 | 127.8 | 69.0 | 198.0 | |

| Indiana | IN | $47,647 | 122.3 | 70.7 | 184.5 | |

| Iowa | IA | $51,339 | 121.1 | 64.9 | 171.2 | |

| Kansas | KS | $47,498 | 120.9 | 65.0 | 170.8 | |

| Kentucky | KY | $41,320 | 144.7 | 77.2 | 170.7 | |

| Louisiana | LA | $40,016 | 101.9 | 70.2 | 147.1 | |

| Maine | ME | $48,592 | 118.0 | 59.0 | 190.0 | |

| Maryland | MD | $67,364 | 125.1 | 58.0 | 218.5 | |

| Massachusetts | MA | $60,434 | 116.8 | 57.1 | 155.6 | |

| Michigan | MI | $51,305 | 122.5 | 70.8 | 181.2 | |

| Minnesota | MN | $59,910 | 120.5 | 65.5 | 172.8 | |

| Mississippi | MS | $36,674 | 112.5 | 81.2 | 160.2 | |

| Missouri | MO | $47,507 | 120.6 | 65.4 | 172.3 | |

| Montana | MN | $42,524 | 111.0 | 58.0 | 175.0 | |

| Nebraska | NE | $52,134 | 120.6 | 65.3 | 172.4 | |

| Nevada | NV | $54,500 | 111.5 | 58.0 | 175.3 | |

| New Hampshire | NH | $64,512 | 115.6 | 57.4 | 159.0 | |

| New Jersey | NJ | $71,284 | 135.8 | 53.1 | 201.1 | |

| New Mexico | NM | $42,850 | 111.0 | 58.0 | 175.0 | |

| New York | NY | $51,763 | 111.5 | 56.0 | 184.9 | |

| North Carolina | NC | $44,441 | 104.6 | 65.1 | 165.7 | |

| North Dakota | ND | $45,184 | 122.0 | 64.0 | 169.0 | |

| Ohio | OH | $48,884 | 122.6 | 69.8 | 185.0 | |

| Oklahoma | OK | $41,497 | 103.6 | 69.9 | 143.2 | |

| Oregon | OR | $49,495 | 111.0 | 51.0 | 173.8 | |

| Pennsylvania | PA | $51,416 | 130.0 | 60.0 | 203.7 | |

| Rhode Island | RI | $55,980 | 115.0 | 57.0 | 151.0 | |

| South Carolina | SC | $43,338 | 100.5 | 71.3 | 161.5 | |

| South Dakota | SD | $48,051 | 122.0 | 64.0 | 169.0 | |

| Tennessee | TN | $43,458 | 113.9 | 79.8 | 167.4 | |

| Texas | TX | $45,966 | 104.7 | 69.9 | 162.0 | |

| Utah | UT | $59,395 | 135.0 | 57.0 | 188.0 | |

| Vermont | VE | $55,716 | 117.8 | 59.0 | 187.1 | |

| Virginia | VA | $59,126 | 110.5 | 62.6 | 187.7 | |

| Washington | WA | $57,148 | 111.9 | 51.9 | 175.0 | |

| West Virginia | WV | $40,611 | 107.4 | 67.3 | 176.0 | |

| Wisconsin | WI | $52,223 | 121.3 | 70.2 | 183.9 | |

| Wyoming | WY | $49,777 | 114.0 | 58.3 | 172.7 |

The database depicted in Figure 1-4 was used to conduct the analyses reported in Figure 1-2 and Figure 1-3. The first two columns in the database are examples of metadata: the state name (STATE_NAME) and state abbreviation (STATE_ABBR). These are descriptive attributes of the cases, but they are not analytically meaningful. For example, we would not expect soda consumption to be determined by a state's abbreviation. The last four columns in the database are examples of variables. The first variable (MED_INCOME) is each state's median income. The other three variables represent annual state sweetened snack consumption in pounds per person (LB_SNACKS), soft drink consumption in gallons per person (GAL_SODA), and fruit and vegetable consumption in pounds per person (LB_FRUVEG). As in Figure 1-4, metadata are usually listed first in a database, followed by variables. The cases are usually sorted in order using the first metadata column as a case identifier. In this case, the data are sorted in alphabetical order by state name.

The cases in a database can be political units (like states or countries), organizations (like schools or companies), persons (like individuals or families), or any other kind of entity. The database that was used in Figure 1-1 is presented in Figure 1-5. In this database, the metadata appear in the first column (CHILD_ID) and the fifth column (MOTHER_ID). The gender of each child is reported in the third column (GENDER). Gender is recorded as "1" for men and "2" for women and mother's race is recorded as "1" for white and "2" for non-white. Income variables for the children's families (FAM_INC) and their mothers' families (PAR_INC) appear in the second and fifth columns. Notice that the incomes of the children's families are rounded off, while the incomes of the mothers' families are exact. Researchers using these data have to accept inconsistencies like this and work with them, since there's no way to go back and re-collect the data. We're stuck using the data as they exist in the database.

| CHILD_ID | FAM_INC | GENDER | M_RACE | MOTH_ID | PAR_INC |

|---|---|---|---|---|---|

| 2001 | $150,000 | 2 | 1 | 20 | $113,750 |

| 4902 | $90,000 | 1 | 1 | 49 | $90,090 |

| 23102 | $120,000 | 2 | 1 | 231 | $85,811 |

| 25202 | $68,000 | 1 | 1 | 252 | $13,679 |

| 55001 | $61,000 | 2 | 1 | 550 | $71,344 |

| 76803 | $100,000 | 2 | 1 | 768 | $56,784 |

| 82802 | $50,000 | 1 | 1 | 828 | $64,246 |

| 97101 | $59,000 | 2 | 1 | 971 | $32,396 |

| 185301 | $150,000 | 1 | 1 | 1853 | $176,904 |

| 226801 | $10,000 | 2 | 2 | 2268 | $3,786 |

| 236901 | $100,000 | 1 | 1 | 2369 | $182,002 |

| 294903 | $150,000 | 2 | 1 | 2949 | $62,062 |

| 302301 | $388,387 | 2 | 1 | 3023 | $120,120 |

| 315101 | $60,000 | 2 | 1 | 3151 | $37,310 |

| 363502 | $150,000 | 2 | 1 | 3635 | $64,370 |

| 385101 | $40,000 | 1 | 1 | 3851 | $70,980 |

| 396204 | $100,000 | 1 | 1 | 3962 | $62,972 |

| 402803 | $80,000 | 1 | 1 | 4028 | $111,202 |

| 411001 | $75,000 | 1 | 1 | 4110 | $10,804 |

| 463102 | $75,000 | 2 | 1 | 4631 | $61,880 |

| 463801 | $25,000 | 1 | 1 | 4638 | $25,859 |

| 511403 | $180,000 | 1 | 1 | 5114 | $105,196 |

| 512302 | $70,000 | 2 | 1 | 5123 | $41,860 |

| 522402 | $50,000 | 2 | 1 | 5224 | $43,680 |

| 542402 | $100,000 | 1 | 1 | 5424 | $35,736 |

| 548301 | $30,000 | 1 | 2 | 5483 | $46,279 |

| 552601 | $40,000 | 2 | 1 | 5526 | $30,940 |

| 576601 | $28,000 | 1 | 2 | 5766 | $21,849 |

| 581101 | $40,000 | 2 | 2 | 5811 | $72,800 |

| 611601 | $80,000 | 2 | 2 | 6116 | $30,940 |

| 616802 | $50,000 | 1 | 2 | 6168 | $11,102 |

| 623801 | $50,000 | 2 | 2 | 6238 | $26,426 |

| 680702 | $45,000 | 1 | 2 | 6807 | $27,300 |

| 749801 | $90,000 | 1 | 2 | 7498 | $43,680 |

| 757802 | $90,000 | 1 | 2 | 7578 | $30,940 |

| 761702 | $5,000 | 2 | 2 | 7617 | $8,008 |

| 771002 | $44,000 | 1 | 2 | 7710 | $9,218 |

| 822603 | $150,000 | 2 | 2 | 8226 | $180,726 |

| 825902 | $36,000 | 2 | 2 | 8259 | $20,457 |

| 848803 | $100,000 | 2 | 2 | 8488 | $79,549 |

| 855802 | $32,000 | 2 | 2 | 8558 | $7,280 |

| 898201 | $60,000 | 1 | 2 | 8982 | $13,523 |

| 906302 | $11,000 | 2 | 2 | 9063 | $9,218 |

| 943401 | $20,000 | 1 | 2 | 9434 | $7,571 |

| 977802 | $150,000 | 1 | 2 | 9778 | $96,460 |

| 1002603 | $32,000 | 2 | 2 | 10026 | $30,476 |

| 1007202 | $52,000 | 2 | 2 | 10072 | $17,734 |

| 1045001 | $60,000 | 2 | 2 | 10450 | $78,315 |

| 1176901 | $30,000 | 2 | 1 | 11769 | $66,375 |

| 1200001 | $80,000 | 1 | 1 | 12000 | $70,525 |

Each case in this database is an extended family built around a mother–child pair. The children's family incomes include the incomes of their spouses, and the mothers' family incomes include the incomes of their spouses, but the mothers' spouses may or may not be the fathers of the children in the database. Since the data were collected on mother–child pairs, we have no way to know the incomes of the children's biological fathers unless they happen to have been married to the mothers in 1987 when the mothers' income data were collected. Obviously we'd like to know the children's fathers' incomes levels, but the data were never explicitly collected. If the parents were not married as of 1987, the biological fathers' data are gone forever. Data limitations like the rounding off of variables and the fact that variables may not include all the data we want are major sources of error in statistical models.

1.3: Dependent Variables and Independent Variables

[edit | edit source]In social statistics we're usually interested in using some variables to explain other variables. For example, in operationalizing the theory that persons eat junk food because they can't afford to eat high-quality food we used the variable "state median income" (MED_INCOME) in a statistical model (specifically, a scatter plot) to explain the variable "soft drink consumption" (GAL_SODA). In this simple model, we would say that soft drink consumption depends on state median income. Dependent variables are variables that are thought to depend on other variables in a model. They are outcomes of some kind of causal process. Independent variables are variables that are thought to cause the dependent variables in a model. It's easy to remember the difference. Dependent variables depend. Independent variables are independent; they don't depend on anything.

Whether a variable is independent or dependent is a matter of conceptualization. If a researcher thinks that one variable causes another, the cause is the independent variable and the effect is the dependent variable. The same variable can be an independent variable in one model but a dependent variable in another. Within any one particular model, however, it should be clear which variables are independent and which variables are dependent. The same variable can't be both: a variable can't cause itself.

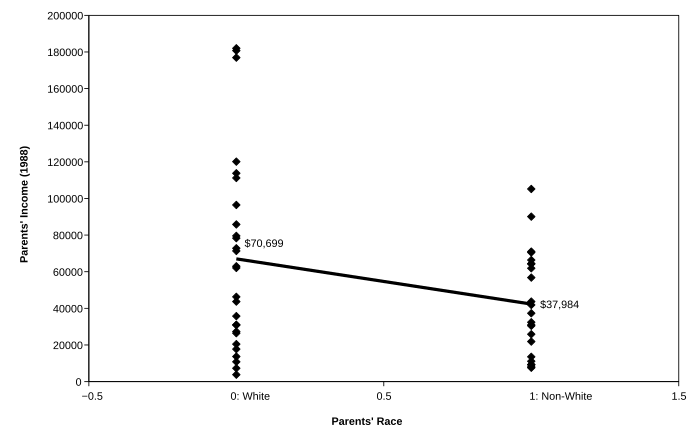

For an example of how a variable could change from independent to dependent, think back to Figure 1-1. In that figure, parents' income is the independent variable and children's income is the dependent variable (in the model, parents' income causes children's income). Parents' income, however, might itself be caused by other variables. We could operationalize a statistical model in which the parents' family income (the variable PAR_INC) depends on the parents' race (M_RACE). We use the mother's race to represent the race of both parents, since we don't have data for each mother's spouse (if any). A scatter plot of parents' family income by race is presented in Figure 1-6. Remember that the variable M_RACE is coded so that 0 = white and 1 = non-white. Clearly, the white parents had much higher family incomes (on average) than the non-white parents, almost twice as high. As with any statistical model, however, there is still a lot of error: race explains a lot in America, but it doesn't explain everything.

Just like parents' income, any variable can be either an independent variable or a dependent variable. It all depends on the context. All of the dependent variables and independent variables that have been used so far in this chapter are summarized in Figure 1-7. An arrow (→) has been used to indicate which variable is thought to cause which. Remember, in each model the independent variable causes the dependent variable. That's the same as saying that the dependent variables depend on the independent variables. Since parents' income has been used as both an independent variable (Figure 1-1) and as a dependent variable (Figure 1-6) it appears twice in the table. State median income has also been used twice, both times as an independent variable (Figure 1-2 and Figure 1-3).

| Figure | Independent Variable | Dependent Variable | Model | Trend |

|---|---|---|---|---|

| Figure 1-1 | Parents' income → | Children's income | Scatter plot | Up |

| Figure 1-2 | State median income → | Soft drink consumption | Scatter plot | Down |

| Figure 1-3 | State median income → | Sweetened snack consumption | Scatter plot | Up |

| Figure 1-6 | Parents' race → | Parents' income | Scatter plot | Down |

In each example reported in Table 1-1, the statistical model used to understand the relationship between the independent variable and the dependent variable has been a scatter plot. In a scatter plot, the independent variable is always depicted on the horizontal (X) axis. The dependent variable is always depicted on the vertical (Y) axis. A line has been drawn through the middle of the cloud of points on each scatter plot to help illustrate the general trend of the data. In Figure 1-1 the general trend is up: parents' income is positively related to children's income. In Figure 1-2 the general trend is down: state median income is negatively related to soft drink consumption. In Figure 1-3 and Figure 1-6 the trends are again up and down, respectively. Whether the trend is up or down, the existence of a trend indicates a relationship between the independent variable and the dependent variable.

A scatter plot is a very simple statistical model that helps show the overall relationship between one independent variable and one dependent variable. In future chapters, we will study more sophisticated statistical models. Many of them will allow for multiple independent variables of different kinds, but every model used in this book will have just one dependent variable. Models with multiple dependent variables exist, but they are much more complicated and won't be covered here.

1.4: Inferring Causality

[edit | edit source]- Optional/advanced

Social scientists are almost always interested in making claims about causality, in claiming that one variable causes another. We suspect that sexism in the workplace leads to lower wages for women, that education leads to greater life fulfillment, that social inequality leads to higher levels of violence in society. The problem is that in the social sciences it is almost always impossible to prove that one variable causes another. Instead, social scientists must infer causality as best they can using the facts—and reasoning—at their disposal.

It is so difficult to establish causality in the social sciences because most social science questions cannot be studied using experiments. In an experiment, research subjects are randomly assigned to two groups, an experimental group and a control group. The subjects in the experimental group receive some treatment, while the subjects in the control group receive a different treatment. At the end of the experiment, any systematic difference between the subjects in the two groups must be due to differences in their treatments, since the two groups have otherwise identical backgrounds and experiences.

In the social sciences, experiments are usually impossible. For example, we strongly suspect that sexism in the workplace causes lower wages for women. The only way to know for sure whether or not this is true would be to recruit a group of women and randomly assign them to work in different workplaces, some of them sexist and some of them not. The workplaces would have to be identical, except for the sexism. Then, after a few years, we could call the women back to check up on their wages. Any systematic differences in women's wages between those who worked in sexist workplaces and those who worked in non-sexist workplaces could then be attributed to the sexism, since we would know for certain that there were no other systematic differences between the groups and their experiences.

Of course, experiments like this are impossible. As a substitute for experiments, social scientists conduct interviews and surveys. We ask women whether or not they have experienced sexism at work, and then ask them how much money they make. If the women who experience sexism make less money than the women who do not experience sexism, we infer that perhaps that difference may be due to actual sexism in the workplace.

Social scientists tend to be very cautious in making causal inferences, however, because many other factors may be at work. For example, it is possible that the women in the study who make less money tend incorrectly to perceive their workplaces as being sexist (reverse causality). It is even possible that high-stress working environments in which persons are being laid off result both in sexist attitudes among managers and in lower wages for everyone, including women (common causality). Many other alternatives are also possible. Causality is very difficult to establish outside the experimental framework.

Most social scientists accept three basic conditions that, taken together, establish that an independent variable actually causes a dependent variable. They are:

- Correlation: when the independent variable changes, the dependent variable changes

- Precedence: the independent variable logically comes before the dependent variable

- Non-spuriousness: the independent variable and the dependent variable are not both caused by some other factor

Of the three conditions, correlation is by far the easiest to show. All of the scatter plots depicted in this chapter demonstrate correlation. In each case, the values of the dependent variable tends to move in one direction (either up or down) in correspondence with values of the independent variable.

Precedence can also be easy to demonstrate—sometimes. For example, in Figure 1-6 it is very clear that race logically comes before income. It wouldn't make any sense to argue the opposite, that persons' incomes cause their racial identities. At other times precedence can be much more open to debate. For example, many development sociologists argue that universal education leads to economic development: an educated workforce is necessary for development. It is possible, however, that the opposite is true, that economic development leads to universal education: when countries are rich enough to afford it, they pay for education for all their people. One of the major challenges of social policy formation is determining the direction of causality connecting variables.

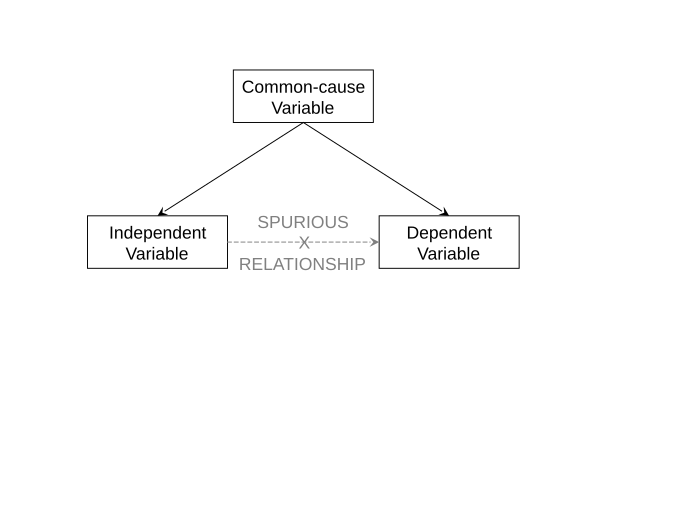

Non-spuriousness, on the other hand, is almost always very difficult to establish. An observed relationship between two variables is called "spurious" when it doesn't reflect any real connection between the variables. For example, smoking tobacco can cause lung cancer and smoking tobacco can cause bad breath, but bad breath doesn't cause lung cancer. This general logic of spuriousness is depicted in Figure 1-8. In Figure 1-8, a spurious relationship exists between two variables in a statistical model. The real reason for the observed correlation between the independent variable and the dependent variable is that both are caused by a third, common-cause variable. Situations like this are very common in the social sciences. In order to be able to claim that one variable causes another, a social scientist must show that an observed relationship between the independent variable and the dependent variable is not spurious.

The problem with demonstrating non-spuriousness is that there can be many possible reasons why a relationship might be spurious. Returning to the relationship between parents' income and children's income, it is easy to see that there is a correlation between the two variables (Figure 1-1). It is also pretty obvious that parents' income precedes children's income. But what about non-spuriousness? There are many reasons why the relationship between parents' income and children's income might be spurious. One we've already seen: race. Non-white parents tend to have non-white children, so it's possible that instead of parent's income causing children's income, the truth is that the family's race determines both the parents' and the children's incomes (race is a common-cause variable). This could account for the observed correlation between parents' income and children's income. Other possible common-cause variables include:

- The family's area of residence

- The degree to which the family values money-making

- Parents' educational levels (which can influence children's educational choices)

- The parents' number of children

This last common-cause variable is an instructive example. In theory, having large numbers of children could force parents to stay home instead of working, lowering their incomes and making it difficult for them to afford college educations for their children, who could then have lower incomes as well. This might seem to most reasonable persons like a very unlikely scenario. The problem is that different persons have different ideas about what is reasonable. In order to establish the non-spuriousness of a relationship, researchers don't just have to convince themselves. They have to convince others, and everyone has a different idea of what might possibly create a spurious relationship between two variables. In the end, it is impossible to prove non-spuriousness. Instead, social scientists argue until they reach a consensus—or they just keep arguing. Causality is always subject to debate.

1.5: Case Study: Education Spending and Student Performance

[edit | edit source]Everyone knows that there are good schools and there are bad schools. The first question most parents ask when they're looking at a new home is "how are the schools?" Common sense suggests that the good schools are, on average, the rich schools. Everyone wants their children to go to schools that have brand-new computer labs, impressive sports facilities, freshly painted hallways, and nice green lawns. Parents also want their kids to receive individualized attention in small classes taught by talented, experienced teachers with master's degrees and doctorates. Active band, chorus, and art programs are also a plus. All this takes money.

A reasonable generalization from the observation that parents want to send their kids to schools that cost a lot of money to run is that states that spend more money on education will have better schools than states that spend less money on education. This generalization can be conceptualized into the theory that overall student performance depends (at least in part) on the amount of money a state spends on each student. This theory can be examined using data from the US National Center for Education Statistics (NCES). A database downloaded from the NCES website is reproduced in Figure 1-9. The cases are the 50 US states. There are two metadata columns (STATE and ABBR) and three variables (SPEND, READ_NAT, and MATH):

SPEND– Total state and local education spending per pupilREAD_NAT– State-average reading scores for native English-speaking 8th grade studentsMATH– State-average math scores for all 8th grade students

| STATE | ABBR | SPEND | READ_NAT | MATH |

|---|---|---|---|---|

| Alabama | AL | $10,356 | 255.5 | 268.5 |

| Alaska | AK | $17,471 | 263.7 | 283.0 |

| Arizona | AZ | $9,457 | 260.8 | 277.3 |

| Arkansas | AR | $9,758 | 258.9 | 276.0 |

| California | CA | $11,228 | 261.5 | 270.4 |

| Colorado | CO | $10,118 | 268.5 | 287.4 |

| Connecticut | CT | $16,577 | 272.8 | 288.6 |

| Delaware | DE | $13,792 | 265.6 | 283.8 |

| District of Columbia | DC | $17,394 | 243.2 | 253.6 |

| Florida | FL | $10,995 | 265.3 | 279.3 |

| Georgia | GA | $11,319 | 260.9 | 277.6 |

| Hawaii | HI | $14,129 | 256.9 | 273.8 |

| Idaho | ID | $7,965 | 266.4 | 287.3 |

| Illinois | IL | $12,035 | 265.6 | 282.4 |

| Indiana | IN | $11,747 | 266.1 | 286.8 |

| Iowa | IA | $11,209 | 265.6 | 284.2 |

| Kansas | KS | $11,805 | 268.4 | 288.6 |

| Kentucky | KY | $9,848 | 267.0 | 279.3 |

| Louisiana | LA | $11,543 | 253.4 | 272.4 |

| Maine | ME | $13,257 | 267.9 | 286.4 |

| Maryland | MD | $15,443 | 267.5 | 288.3 |

| Massachusetts | MA | $15,196 | 274.5 | 298.9 |

| Michigan | MI | $11,591 | 262.4 | 278.3 |

| Minnesota | MN | $12,290 | 271.8 | 294.4 |

| Mississippi | MS | $8,880 | 251.5 | 265.0 |

| Missouri | MO | $11,042 | 267.0 | 285.8 |

| Montana | MT | $10,958 | 271.4 | 291.5 |

| Nebraska | NE | $11,691 | 267.8 | 284.3 |

| Nevada | NV | $10,165 | 257.4 | 274.1 |

| New Hampshire | NH | $13,019 | 271.0 | 292.3 |

| New Jersey | NJ | $18,007 | 272.9 | 292.7 |

| New Mexico | NM | $11,110 | 258.5 | 269.7 |

| New York | NY | $19,081 | 266.0 | 282.6 |

| North Carolina | NC | $8,439 | 261.1 | 284.3 |

| North Dakota | ND | $11,117 | 269.5 | 292.8 |

| Ohio | OH | $12,476 | 268.8 | 285.6 |

| Oklahoma | OK | $8,539 | 260.4 | 275.7 |

| Oregon | OR | $10,818 | 267.8 | 285.0 |

| Pennsylvania | PA | $13,859 | 271.2 | 288.3 |

| Rhode Island | RI | $15,062 | 261.3 | 277.9 |

| South Carolina | SC | $10,913 | 257.5 | 280.4 |

| South Dakota | SD | $9,925 | 270.4 | 290.6 |

| Tennessee | TN | $8,535 | 261.3 | 274.8 |

| Texas | TX | $9,749 | 263.2 | 286.7 |

| Utah | UT | $7,629 | 267.2 | 284.1 |

| Vermont | VT | $16,000 | 272.6 | 292.9 |

| Virginia | VA | $11,803 | 266.6 | 286.1 |

| Washington | WA | $10,781 | 268.7 | 288.7 |

| West Virginia | WV | $11,207 | 254.9 | 270.4 |

| Wisconsin | WI | $12,081 | 266.7 | 288.1 |

| Wyoming | WY | $18,622 | 268.6 | 286.1 |

The theory that overall student performance depends on the amount of money a state spends on each student can be operationalized into two specific hypotheses:

- State spending per pupil is positively related to state average reading scores

- State spending per pupil is positively related to state average mathematics scores

In Figure 1-10 and Figure 1-11, scatter plots are used as statistical models for relating state spending to state reading and math scores. The dependent variable in Figure 1-10 is READ_NAT (reading performance for native English-speaking students) and the dependent variable in Figure 1-11 is MATH (mathematics performance). The independent variable in both figures is SPEND. In both figures state average scores do tend to be higher in states that spend more, but there is a large amount of error in explaining scores. There are probably many other determinants of student test scores besides state spending. Scores might be affected by things like parental education levels, family income levels, levels of student drug abuse, and whether or not states "teach to the test" in an effort to artificially boost results. Nonetheless, it is clear that (on average) the more states spend, the higher their scores.

The results of these data analyses tend to confirm the theory that overall student performance depends (at least in part) on the amount of money a state spends on each student. This theory may or may not really be true, but the evidence presented here is consistent with the theory. The results suggest that if states want to improve their student test scores, they should increase their school budgets. In education, as in most things, you get what you pay for.

Chapter 1 Key Terms

[edit | edit source]- Conceptualization is the process of developing a theory about some aspect of the social world.

- Cases are the individuals or entities about which data have been collected.

- Databases are arrangements of data into variables and cases.

- Dependent variables are variables that are thought to depend on other variables in a model.

- Generalization is the act of turning theories about specific situations into theories that apply to many situations.

- Independent variables are variables that are thought to cause the dependent variables in a model.

- Metadata are additional attributes of cases that are not meant to be included in analyses.

- Operationalization is the process of turning a social theory into specific hypotheses about real data.

- Scatter plots are very simple statistical models that depict data on a graph.

- Statistical models are mathematical simplifications of the real world.

- Variables are analytically meaningful attributes of cases.

Linear Regression Models

[edit | edit source]Persons all over the world worry about crime, especially violent crime. Americans have more reason to worry than most. The United States is a particularly violent country. The homicide rate in the United States is roughly three times that in England, four times that in Australia, and five times that in Germany. Japan, a country of over 125 million persons, experiences fewer murders per year than Pennsylvania, with fewer than 12.5 million persons. Thankfully, American murder rates have fallen by almost 50% in the past 20 years, but they're still far too high.

Violent crime is, by definition, traumatic for victims and their families. A person who has been a victim of violent crime may never feel truly safe in public again. Violent crime may also be bad for society. Generalizing from the individual to the social level, if persons feel unsafe, they may stay home, avoid public places, and withdraw from society. This concern can be conceptualized into a formal theory: where crime rates are high, persons will feel less safe leaving their homes. A database that can be used to evaluate this theory has been assembled in Figure 2-1 using data available for download from the Australian Bureau of Statistics website. Australian data have been used here because Australia has just 8 states and territories (versus 50 for the United States), making it easier to label specific states on a scatter plot.

| STATE_TERR | CODE | VICTIM_PERS | UNSAFE_OUT | VICTIM_VIOL | STRESS | MOVED5YR | MED_INC |

|---|---|---|---|---|---|---|---|

| Australian Capital Territory | ACT | 2.8 | 18.6 | 9.9 | 62.1 | 39.8 | $712 |

| New South Wales | NSW | 2.8 | 17.4 | 9.3 | 57.0 | 39.4 | $565 |

| Northern Territory | NT | 5.7 | 30.0 | 18.2 | 63.8 | 61.3 | $670 |

| Queensland | QLD | 3.0 | 17.3 | 13.5 | 64.4 | 53.9 | $556 |

| South Australia | SA | 2.8 | 21.8 | 11.4 | 58.2 | 38.9 | $529 |

| Tasmania | TAS | 4.1 | 14.3 | 9.8 | 59.1 | 39.6 | $486 |

| Victoria | VIC | 3.3 | 16.8 | 9.7 | 57.5 | 38.8 | $564 |

| Western Australia | WA | 3.8 | 20.9 | 12.8 | 62.8 | 47.3 | $581 |

The cases in the Australian crime database are the eight states and territories of Australia. The columns include two metadata items (the state or territory name and postal code). Six variables are also included:

VICTIM_PERS– The percent of persons who were the victims of personal crimes (murder, attempted murder, assault, robbery, and rape) in 2008UNSAFE_OUT– The percent of persons who report feeling unsafe walking alone at night after darkVICTIM_VIOL– The percent of persons who report having been the victim of physical or threatened violence in the past 12 monthsSTRESS– The percent of persons who report having experienced at least one major life stressor in the past 12 monthsMOVED5YR– The percent of persons who have moved in the previous 5 yearsMED_INC– State median income

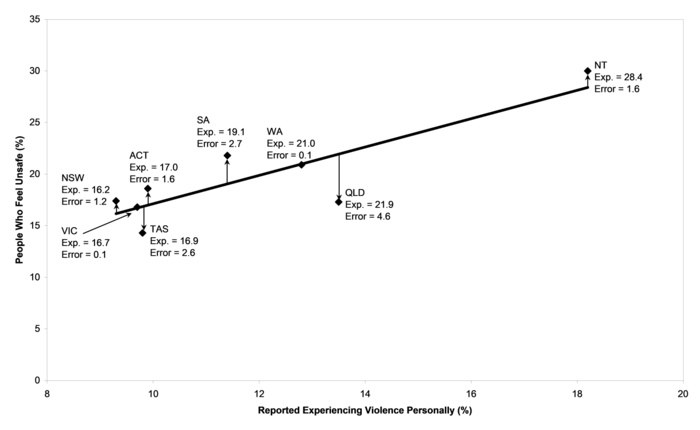

The theory that where crime rates are high, persons will feel less safe leaving their homes can be operationalized using these data into the specific hypothesis that the relationship between the variables VICTIM_PERS and UNSAFE_OUT will be positively related across the 8 Australian states and territories. In this statistical model, VICTIM_PERS (the crime rate) is the independent variable and UNSAFE_OUT (persons' feelings of safety) is the dependent variable. The actual relationship between the two variables is plotted in Figure 2-2. Each point in the scatter plot has been labeled using its state postal code. This scatter plot does, in fact, show that the relationship is positive. This is consistent with the theory that where crime rates are high, persons will feel less safe leaving their homes.

As usual, Figure 2-2 includes a reference line the runs through the middle of all of the data points. Also as usual, there is a lot of error in the scatter plot. Fear of going out alone at night does rise with the crime rate, but not in every case. To help clarify the overall trend in fear of going out, Figure 2-2 also includes a new, additional piece of information: the amount of error that is associated with each observation (each state). Instead of thinking of a scatter plot as just a collection of points that trends up or down, it is possible to think of a scatter plot as a combination of trend (the line) and error (deviation from the line). This basic statistical model—a trend plus error—is the most widely used statistical model in the social sciences.

In Figure 2-2, three states fall almost exactly on the trend line: New South Wales, Queensland, and Western Australia. The persons in these three states have levels of fear about going out alone at night that are just what might be expected for states with their levels of crime. In other words, there is almost no error in the statistical model for fear in these states. Persons living in other states and territories have more fear (South Australia, Australian Capital Territory, Northern Territory) or less fear (Victoria, Tasmania) than might be expected based on their crime rates. Tasmania in particular has relatively high crime rates (the second highest in Australia) but very low levels of fear (the lowest in Australia). This means that there is a lot of error in the statistical model for Tasmania. While there is definitely an upward trend in the line shown in Figure 2-2, there is so much error in individual cases that we might question just how useful actual crime rates are for understanding persons' feelings of fear about going out at night.

This chapter introduces the linear regression model, which divides the relationship between a dependent variable and an independent variable into a trend plus error. First and foremost, the linear regression model is just a way of putting a line on a scatter plot (Section 2.1). There are many possible ways to draw a line through data, but in practice the linear regression model is the one way that is used in all of social statistics. Second, line on a scatter plot actually represents a hypothesis about how the dependent variable is related to an independent variable (Section 2.2). Like any line, it has a slope and an intercept, but social scientists are mainly interested in evaluating hypotheses about the slope. Third, it's pretty obvious that a positive slope means a positive relationship between the two variables, while a negative slope means a negative relationship (Section 2.3). The steeper the slope, the more important the relationship between the two variables is likely to be. An optional section (Section 2.4) explains some of the mathematics behind how regression lines are actually drawn.

Finally, this chapter ends with an applied case study of the relationship between property crime and murder rates in the United States (Section 2.5). This case study illustrates how linear regression models are used to put lines on scatter plots, how hypotheses about variables are turned into hypotheses about the slopes of these lines, and the difference between positive and negative relationships. All of this chapter's key concepts are used in this case study. By the end of this chapter, you should have a basic understanding of how regression models can shed light on the relationships connecting independent and dependent variables in the social sciences.

2.1. Introducing the Linear Regression Model

[edit | edit source]When social scientists theorize about the social world, they don't usually theorize in straight-line terms. Most social theorists would never come up with a theory that said "persons' fear of walking along at night will rise in exactly a straight line as the crime rate in their neighborhoods rise." Instead, theories about the social world are much more vague: "persons will feel less safe leaving their homes where crime rates are high." All the theories that were examined in Chapter 1 were also stated in vague language that said nothing about straight lines:

- Rich parents tend to have rich children

- Persons eat junk food because they can't afford to eat high-quality food

- Racial discrimination in America leads to lower incomes for non-whites

- Higher spending on education leads to better student performance on tests

When theories say nothing about the specific shape of the relationship between two variables, a simple scatter plot is—technically—the appropriate way to evaluate them. With one look at the scatter plot anyone can see whether the dependent variable tends to rise, fall, or stay the same across values of the independent variable. The real relationship between the two variables might be a line, a curve, or an even more complicated pattern, but that is unimportant. The theories say nothing about lines or curves. The theories just say that when the independent variable goes up, the dependent variable goes up as well.

However, there are problems with scatter plots. Sometimes it can be hard to tell whether they trend upwards or not. For example, many Americans believe that new immigrants to America have large numbers of children, overwhelming schools and costing the taxpayers a lot of money. Figure 2-3 plots the relationship between birth rates (independent variable) and levels of international immigration (dependent variable) for 3193 US counties. Does the birth rate rise with greater immigration? It's hard to say from just the scatter plot, without a line. It turns out that birth rates do rise with immigration rates, but only very slightly.

As Figure 2-3 illustrates, another problem with scatter plots is that they become difficult to read when there are a large number of cases in the database being analyzed. Scatter plots also become difficult to read when there is more than one independent variable, as there will be later in this book. The biggest problem with using scatter plots to evaluate theories, though, is that different persons might have different opinions about then. One person might see a rising trend while someone else thinks the trend is generally flat or declining. Without a reference line to give a firm answer, it may be impossible to reach agreement on whether the theory being evaluated is or is not correct. For these (and other) reasons, social scientists don't usually rely on scatter plots. Scatter plots are widely used in the social sciences, but they are used to get an overall impression of the data, not to evaluate theories.

Instead, social scientists evaluate theories using straight lines like the reference lines that were drawn on the scatter plots above and in Chapter 1. These lines are called regression lines, and are based on statistical models called linear regression models. Linear regression models are statistical models in which expected values of the dependent variable are thought to rise or fall in a straight line according to values of the independent variable. Linear regression models (or just "regression models") are statistical models, meaning that they mathematical simplifications of the real world. Real variables may not rise or fall in a straight line, but in the linear regression model we simplify things to focus only on this one aspect of variables.

Of course, dependent variables don't really rise or fall in straight lines as regression models would suggest. Social scientists use straight lines because they are convenient, even though they may not always be theoretically appropriate. Other kinds of relationships between variables are possible, but there are many good reasons for using straight lines instead. Some of them are:

- A straight line is the simplest way two variables could be related, so it should be used unless there's a good reason to suspect a more complicated relationship

- Straight lines can be compared using just their slopes and intercepts (you don't need every piece of data, as with comparing scatter plots)

- Usually there's so much error in social science models that we can't tell the difference between a straight line relationship and other relationships anyway

The straight line a linear regression model is drawn through the middle of the cloud of points in a scatter plot. It is drawn in such a way that each point along the line represents the most likely value of the dependent variable for any given value of the independent variable. This is the value that the dependent variable would be expected to have if there were no error in the model. Expected values are the values that a dependent variable would be expected to have based solely on values of the independent variable. Figure 2-4 depicts a linear regression model of persons' fear of walking along at night. The dependent variable from Figure 2-2, the percent of persons who feel unsafe, is regressed on a new independent variable, the percent of persons who reported experiencing violence personally. There is less error in Figure 2-4 than we saw in Figure 2-2. Tasmania in particular now falls very close to the reference line of expected values.

The expected values for the percent of persons who feel unsafe walking at night have been noted right on the scatter plot. They are the values of the dependent variable that would have been expected based on the regression model. For example, in this model the expected percentage of persons who feel unsafe walking at night in Tasmania would be 16.9%. In other words, based on reported levels of violence experienced by persons in Tasmania, we would expect about 16.9% of Tasmanians to feel unsafe walking alone at night. According to our data, 14.3% of persons in Tasmania report feeling unsafe walking at night (see the variable UNSAFE_OUT in Figure 2-1 and read across the row for Tasmania). Since the regression model predicted 16.9% and the actual value was 14.3%, the error for Tasmania in Figure 2-4 was 2.6% ().

Regression error is the degree to which an expected value of a dependent variable in a linear regression model differs from its actual value. Regression error is expressed as deviation from the trend of the straight line relationship connecting the independent variable and the dependent variable. In general, regression models that have very little regression error are preferred over regression models that have a lot of regression error. When there is very little regression error, the trend of the regression line will tend to be steeper and the relationship between the independent variable and the dependent variable will tend to be stronger.

There is a lot of regression error in the regression model depicted in Figure 2-4, but less regression error than was observed in Figure 2-2. In particular, the regression error for Tasmania in Figure 2-2 was 7.1%—much higher than in Figure 2-4. This suggests that persons' reports of experiencing violence personally are better predictors of persons' feelings of safety at night than are the actual crime rates in a state. Persons' experiences of safety and fear are very personal, not necessarily based on crime statistics for society as a whole. If policymakers want to make sure that persons feel safe enough to go out in public, they have to do more than just keep the crime rate down. They also have to reduce persons' personal experiences—and persons' perceptions of their personal experiences—of violence and crime. This may be much more difficult to do, but also much more rewarding for society. Policymakers should take a broad approach to making society less violent in general instead of just putting potential criminals in jail.

2.2: The Slope of a Regression Line

[edit | edit source]In the social sciences, even good linear regression models like that depicted in Figure 2-4 tend to have a lot of error. A major goal of regression modeling is to find an independent variable that fits the dependent variable with more trend and less error. An example of a relationship that is almost all trend (with very little error) is depicted in Figure 2-5. The scatter plot in Figure 2-5 uses state birth rates as the independent variable and state death rates as the dependent variable. States with high birth rates tend to have young populations, and thus low death rates. Utah has been excluded because its very high birth rate (over 20 children for every 1000 persons every year) doesn't fit on the chart, but were Utah included its death rate would fall very close to the regression line. One state has an exceptionally high death rate (West Virginia) and one state has an exceptionally low death rate (Alaska).

Thinking about scatter plots in terms of trends and error, the trend in Figure 2-5 is clearly down. Death rates fall as birth rates rise, but by how much? The slope of the regression line gives the answer. Remember that the regression line runs through the expected values of the dependent variable. Slope is the change in the expected value of the dependent variable divided by the change in the value of the independent variable. In other words, it is the change in the regression line for every one point increase in the independent variable. In Figure 2-5, when the independent variable (birth rate) goes up by 1 point, the expected value of the dependent variable (death rate) down by 0.4 points. The slope of the regression line is thus −0.4 / 1, or −0.4. The slope is negative because the line trends down. If the line trended up, the slope would be positive.

An example of a regression line with a positive slope is depicted in Figure 2-6. This line reflects a simple theory of why persons relocate to new communities. Americans are very mobile—much more mobile than persons in most other countries—and frequently move from place to place within America. One theory is that persons go where the jobs are: persons move from places that have depressed economies to places that have vibrant economies. In Figure 2-6, this theory has be operationalized into the hypothesis that counties with higher incomes (independent variable) tend to attract the most migration (dependent variable). In other words, county income is positively related to migration. Figure 2-6 shows that this hypothesis is correct—at least for one state (South Dakota). The slope of the regression line in Figure 2-6 indicates that when county income goes up by $10,000, migration tends to go up by around 8%. The slope is actually .

The positive slope of the regression line in Figure 2-6 doesn't mean that persons always move to counties that have the highest income levels. There is quite a lot of error around the regression line. Lincoln County especially seems to far outside the range of the data from the other counties. Lincoln County is South Dakota's richest and its third most populous. It has grown rapidly over the past ten years as formerly rural areas have been developed into suburbs of nearby Sioux Falls in Minnehaha County. Many other South Dakota counties have highly variable migration figures because they are so small that the opening or closing of one employer can have a big effect on migration. Of the 66 counties in South Dakota, 49 are home to fewer than 10,000 persons. So it's not surprising that the data for South Dakota show a high level of regression error.

If it's true that persons move from places that have depressed economies to places that have expanding economies, the relationship between median income and net migration should be positive in every state, not just South Dakota. One state that is very different from South Dakota in almost every way is Florida. Florida has only two counties with populations under 10,000 persons, and the state is on average much richer than South Dakota. More importantly, lots of persons move to Florida for reasons that have nothing to do with jobs, like climate and lifestyle. Since many persons move to Florida when they retire, the whole theory about jobs and migration may be irrelevant there. To find out, Figure 2-7 depicts a regression of net migration rates on median county income for 67 Florida counties.

As expected, the Florida counties have much more regression error than the South Dakota counties. They also have a smaller slope. In Florida, every $10,000 increase in median income is associated with a 5% increase in the net migration rate, for a slope of . This is just over half the slope for South Dakota. As in South Dakota, one county is growing much more rapidly than the rest of the state. Flagler County in Florida is growing for much the same reason as Lincoln County in Nebraska: it is a formerly rural county that is rapidly developing. Nonetheless, despite the fact that the relationship between income and migration is weaker in Florida than in South Dakota, the slope of the regression line is still positive. This adds more evidence in favor of the theory that persons move from places that have depressed economies to places that have vibrant economies.

2.3: Outliers and Robustness

[edit | edit source]Because there is so much error in the statistical models used by social scientists, it is not uncommon for different operationalizations of the same theory to give different results. We saw this in Chapter 1 when different operationalizations of junk food consumption gave different results for the relationship between state income and junk food consumption (Figure 1-2 versus Figure 1-3). Social scientists are much more impressed by a theory when the theory holds up under different operationalization choices, as in Figure 2.6 and Figure 2.7. Ideally, all statistical models that are designed to evaluate a theory would yield the same results, but in reality they do not. Statistical models can be particularly unstable when they have high levels of error. When there is a lot of error in the model, small changes in the data can lead to big changes in model results.

Robustness is the extent to which statistical models give similar results despite changes in operationalization. With regard to linear regression models, robustness means that the slope of the regression line doesn't change much when different data are used. In a robust regression model, the slope of the regression line shouldn't depend too much on what particular data are used or the inclusion or exclusion of any one case. Linear regression models tend to be most robust when:

- They are based on large numbers of cases

- There is relatively little regression error

- All the cases fall neatly in a symmetrical band around the regression line

Regression models based on small numbers of cases with lots of error and irregular distributions of cases can be very unstable (not robust at all). Such a model is depicted in Figure 2-8. Many persons feel unsafe in large cities because they believe that crime, and particular murder, is very common in large cities. After all, in big cities like New York there are murders reported on the news almost every day. On the other hand, big cities by definition have lots of persons, so their actual murder rates (murders per 100,000 persons) might be relatively low. Using data on the 10 largest American cities, Figure 2-8 plots the relationship between city size and murder rates. The regression line trends downward with a slope of −0.7: as the population of a city goes up by 1 million persons, the murder rate goes down by 0.7 per 100,000. The model suggests that bigger cities are safer than smaller ones.

However, there are several reasons to question the robustness of the model depicted in Figure 2-8. Evaluating this model against the three conditions that are associated with robust models, it fails on every count. First, the model is based on a small number of cases. Second, there is an enormous amount of regression error. Third and perhaps most important, the cases do not fall neatly in a symmetrical band around the regression line. Of the ten cities depicted in Figure 2-8, eight are clustered on the far left side of the scatter plot, one (Los Angeles) is closer to the middle but still in the left half, and one (New York) is far on the extreme right side. New York is much larger than any other American city and falls well outside the cloud of points formed by the rest of the data. It stands alone, far away from all the other data points.

Outliers are data points in a statistical model that fall far away from most of the other data points. In Figure 2-8, New York is a clear outlier. Statistical results based on data that include outliers often are not robust. One outlier out of a hundred or a thousand points usually doesn't matter too much for a statistical model, but one outlier out of just ten points can have a big effect. Figure 2-9 plots exactly the same data as Figure 2-8, but without New York. The new regression line based on the data for the 9 remaining cities has a completely different slope from the original regression line. When New York was included, the slope was negative (−0.7), which indicated that larger cities were safer. With New York excluded, the slope is positive (0.8), indicating that larger cities are more dangerous. The relationship between city size and murder rates clearly is not robust.

It is tempting to argue that outliers are "bad" data points that should always be excluded, but once researchers start excluding points they don't like it can be hard to stop. For example, in Figure 2-9 after New York has been excluded there seems to be a new outlier, Philadelphia. All the other cities line up nicely along the trend line, with Philadelphia sitting all on its own in the upper left corner of the scatter plot. Excluding Philadelphia makes the slope of the regression line even stronger: it increases from 0.8 to 2.0. Then, with Philadelphia gone, Los Angeles appears to be an outlier. Excluding Los Angeles raises the slope even further, to 6.0. The danger here is obvious. If we conduct analyses only on the data points we like, we end up with a very skewed picture of the real relationships connecting variables out in the real world. Outliers should be investigated, but robustness is always an issue for interpretation, not something that can be proved by including or excluding specific cases.

2.4. Least Squared Error

[edit | edit source]- Optional/advanced

In linear regression models, the regression line represents the expected value of the dependent variable for any given value of the independent variable. It makes sense that the most likely place to find the expected value of the dependent variable would be right in the middle of the scatter plot connecting it to the independent variable. For example, in Figure 2-5 the most likely death rate for a state with a birth rate of 15 wouldn't be 16 or 0, but somewhere in the middle, like 8. The death rate indicated by the regression line seems like a pretty average death rate for a state falling in the middle of the range in its birth rate. This seems reasonable so far as it goes. Obviously the regression line has to go somewhere in the middle, but how do we decide exactly where to draw it? One idea might be to draw the regression line so as to minimize the amount of error in the scatter plot. If a scatter plot is a combination of trend and error, it makes sense to want as much trend and as little error as possible. A line through the very middle of a scatter plot must have less error than other lines, right? Bizarrely, the answer is no. This strange fact is illustrated in Figure 2-10, Figure 2-11, and Figure 2-12. These three figures show different lines on a very simple scatter plot. In this scatter plot, there are just four data points:

- X = 1, Y = 2

- X = 1, Y = 8

- X = 5, Y = 5

- X = 5, Y = 8

The actual regression line connecting the independent variable (X) to the dependent variable (Y) is graphed in Figure 2-10. This line passes right through the middle of all four points. Each point is 4 units away from the regression line, so the regression error for each point is 4. The total amount of error for the whole scatter plot is . No other line could be drawn on the scatter plot that would result in less error. So far so good.

The problem is that the regression line (A) isn't the only line that minimizes the amount of error in the scatter plot. Figure 2-11 depicts another line (B). This line doesn't quite run through the middle of the scatter plot. Instead, it's drawn closer to the two low points and farther away from the two high points. It's clearly not as good a line as the regression line, but it turns out to have the same amount of error. The error associated with line B is . It seems that both line A and line B minimize the amount of error in the scatter plot.

That's not all. Figure 2-12 depicts yet another line (C). Line C is an even worse line than line B. It's all the way at the top of the scatter plot, very close to the two high points and very far away from the two low points. It's not at all in the middle of the cloud of points. But the total error is the same: . In fact, any line that runs between the points—any line at all—will give the same error. Many different trends give the same error. This makes it impossible to choose any one line based just on its total error. Another method is necessary.

That method that is actually used to draw regression lines is to draw the line that has the least amount of squared error. Squared error is just that: the error squared, or multiplied by itself. So for example if the error is 4, the squared error is 16 (). For line A in Figure 2-10, the total squared error is or . For line B in Figure 2-11, the total squared error is or . For line C in Figure 2-12, the total squared error is or . The line with the least squared error is line A, the regression line that runs through the very middle of the scatter plot. All other lines have more error.

It turns out that the line with the least squared error is always unique—there's only one line that minimizes the total amount of squared error—and always runs right through the center of the scatter plot. As an added bonus, computers can calculate regression lines using least squared error quickly and efficiently. The use of least squared error is so closely associated with linear regression models that they are often called "least squares regression models." All of the statistical models used in the rest of this book are based on the minimization of squared error. Least squared error is the mathematical principle that underlies almost all of social statistics.

2.5: Case Study: Property Crime and Murder Rates

[edit | edit source]Murder is a rare and horrific crime. It is a tragedy any time a human life is ended prematurely, but that tragedy is even worse when a person's death is intentional, not accidental. Sadly, some of the students using this textbook will know someone who was murdered. Luckily, most of us do not. But almost all of us know someone who has been the victim of a property crime like burglary or theft. Many of us have even been property crime victims ourselves. Property crimes are very common not just in the United States but around the world. In fact, levels of property crime in the US are not particularly high compared to other rich countries. This is odd, because the murder rate in the US are very high. It seems like all kinds of crime should rise and fall together. Do they?

One theory of crime might be that high rates of property crime lead to high rates of murder, as persons move from petty crime to serious crime throughout their criminal careers. Since international data on property crimes might not be equivalent from country to country, it makes sense to operationalize this theory using a hypothesis and data about US crime rates. A specific hypothesis linking property crime to murder would be the hypothesis that property crime rates are positively associated with murder rates for US cities with populations over 100,000 persons. This operationalization excludes small cities because it is possible that smaller cities might have no recorded crimes in any given year.

Data on crime rates of all kinds are available from the US Federal Bureau of Investigation (FBI). In Figure 2-13 these data are used to plot the relationship between property crime rates and murder rates for the 268 American cities with populations of over 100,000 persons. A linear regression model has been used to place a trend line on the scatter plot. The trend line represents the expected value of the murder rate for any given level of property crime. So for example in a city that has a property crime rate of 5,000 per 100,000 persons, the expected murder rate would be 10.2 murders per 100,000 persons. A few cities have murder rates that would be expected given their property crime rates, but there is an enormous amount of regression error. Murder rates are scattered widely and do not cluster closely around the regression line.